Key Takeaways

-

Medicare Part D plans play a critical role in controlling prescription drug expenses, especially with the new $2,000 out-of-pocket cap in 2025.

-

Properly understanding and selecting a Part D plan ensures peace of mind and financial stability for retirees managing chronic conditions or high-cost medications.

Why Prescription Drug Coverage Matters More Than Ever

As you step into retirement, your healthcare needs may shift. One significant change many face is the cost of prescription medications. Without adequate coverage, these expenses can add up quickly and strain your finances. That’s where Medicare Part D steps in, offering essential prescription drug coverage that helps protect your budget while ensuring you get the medications you need.

What Makes Medicare Part D Different?

Unlike other parts of Medicare, Part D focuses solely on prescription drug coverage. It’s available to everyone with Medicare and can be purchased as a stand-alone plan to complement Original Medicare or as part of a Medicare Advantage plan. These plans are offered by private insurers approved by Medicare and are designed to lower your out-of-pocket costs for both generic and brand-name drugs.

The 2025 Updates You Should Know

In 2025, a game-changing cap of $2,000 on out-of-pocket prescription drug expenses has been introduced under Medicare Part D. This new feature provides much-needed financial relief for beneficiaries with high medication costs. Additionally, you can now spread your prescription drug costs over the year in manageable monthly payments, thanks to the Medicare Prescription Payment Plan.

These updates make Medicare Part D an even more valuable tool for safeguarding your finances against the rising costs of medications.

Who Should Consider Medicare Part D?

If you’re enrolled in Original Medicare (Parts A and B) and require prescription medications, a Part D plan is essential. Even if you don’t currently take many medications, enrolling in a plan can protect you from unforeseen future expenses. Medicare Part D isn’t automatically included, so you’ll need to make an active decision to sign up during your Initial Enrollment Period or another eligible time.

Avoiding Late Enrollment Penalties

Signing up for Medicare Part D when you’re first eligible is crucial to avoid a lifetime late enrollment penalty. This penalty increases the longer you go without creditable prescription drug coverage, so don’t delay if you’re eligible.

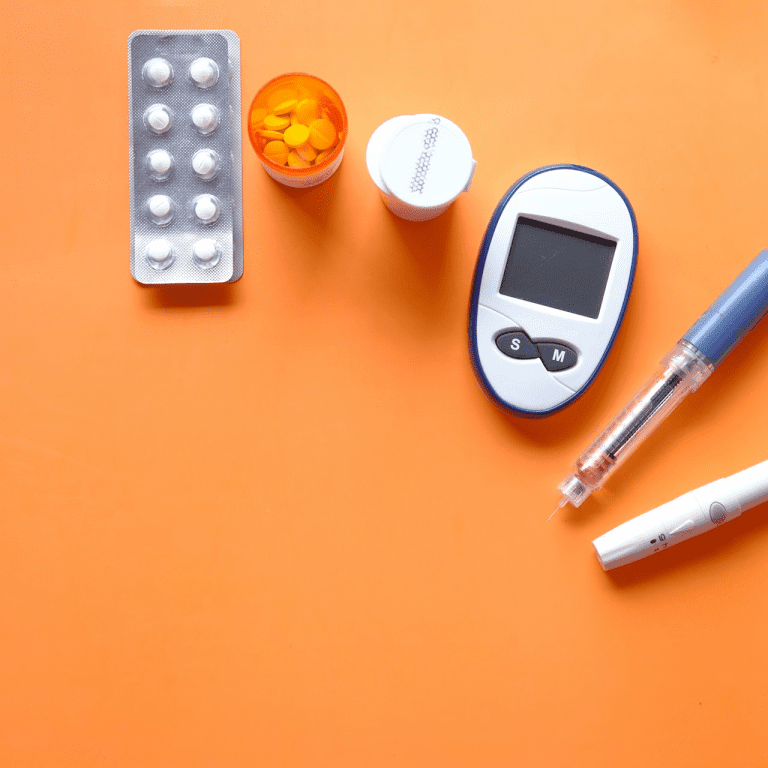

What Does Medicare Part D Cover?

Each Part D plan has its own formulary—a list of covered drugs categorized into tiers. These tiers determine the cost-sharing for medications, with lower-tier drugs typically being more affordable. While formularies vary, all plans must cover medications for common conditions such as diabetes, heart disease, and mental health disorders. Vaccines, like those for shingles, are also included.

Understanding the Drug Tiers

-

Tier 1: Most generic drugs with the lowest cost-sharing.

-

Tier 2: Preferred brand-name drugs at a moderate cost.

-

Tier 3 and above: Non-preferred and specialty drugs, which have higher costs.

If your medication isn’t on a plan’s formulary, you may need to file an exception request or switch to an alternative.

Breaking Down the Costs of Medicare Part D

Medicare Part D costs typically include:

-

Monthly Premiums: Paid to the insurer offering your plan.

-

Annual Deductible: The amount you pay before coverage begins, capped at $590 in 2025.

-

Copayments/Coinsurance: Your share of the costs for covered medications.

The New Out-of-Pocket Cap

In 2025, once your out-of-pocket spending reaches $2,000, Medicare Part D will cover 100% of your drug costs for the rest of the year. This cap is a monumental shift, offering financial security to those who rely on high-cost medications.

How to Choose the Right Plan for You

With numerous Part D plans available, selecting the right one can feel overwhelming. To simplify the process, consider these factors:

1. Your Medication Needs

Create a list of the drugs you take regularly and compare them to the formularies of different plans. Look for plans that cover your medications at a cost you can afford.

2. The Plan’s Pharmacy Network

Make sure your preferred pharmacy is included in the plan’s network. Some plans offer better pricing for specific pharmacies, so it’s worth checking.

3. Cost Considerations

Beyond premiums, evaluate deductibles, copayments, and coinsurance to understand the total cost of each plan.

4. Additional Coverage Options

Some plans offer enhanced coverage for higher premiums, such as including more drugs on their formularies or covering medications during the deductible phase.

When Can You Enroll in Medicare Part D?

There are several opportunities to enroll in or make changes to a Part D plan:

-

Initial Enrollment Period (IEP): This seven-month window surrounds your 65th birthday or the 25th month of receiving disability benefits.

-

Annual Enrollment Period (AEP): From October 15 to December 7 each year, you can join, switch, or drop a Part D plan.

-

Special Enrollment Periods (SEP): Triggered by certain life events, such as moving out of your plan’s service area or losing creditable coverage.

Common Pitfalls to Avoid

Navigating Medicare Part D can be tricky, so steer clear of these common mistakes:

-

Skipping Enrollment: Even if you don’t take medications now, enrolling in a low-cost plan can save you from penalties and unexpected expenses later.

-

Ignoring the Fine Print: Review formularies, pharmacy networks, and cost-sharing details to avoid surprises.

-

Failing to Reassess Annually: Plans change yearly. Reviewing your options during the Annual Enrollment Period ensures your plan still meets your needs.

How to Make Medicare Part D Work for You

Once enrolled, take these steps to maximize your benefits:

-

Use Preferred Pharmacies: Save on out-of-pocket costs by filling prescriptions at in-network pharmacies.

-

Check for Mail-Order Options: Many plans offer discounts for mail-order medications, which can be convenient and cost-effective.

-

Explore Assistance Programs: If you’re struggling with costs, programs like Extra Help can reduce premiums, deductibles, and copayments.

Staying Ahead of Rising Medication Costs

With healthcare expenses continuing to rise, having a Medicare Part D plan is more than just a safety net—it’s a strategic way to manage your budget and health. Taking the time to understand and choose the right plan ensures you’ll be prepared for whatever comes your way.

Ensure Peace of Mind with the Right Plan

Navigating Medicare Part D may seem complex, but the benefits are undeniable. By enrolling in a plan that suits your needs, you’ll gain access to affordable medications and protect your financial health. Don’t wait to secure the coverage you deserve—your future self will thank you.