Key Takeaways

-

Major changes in 2025 Medicare plans affect how you manage drug costs, enroll in coverage, and handle out-of-pocket expenses.

-

Staying informed about annual adjustments can help you avoid unnecessary costs and optimize your benefits.

Understanding the New Medicare Adjustments in 2025

Medicare undergoes updates every year, but 2025 brings some particularly important changes that could affect how you use your benefits. These adjustments are designed to improve affordability, streamline payment processes, and enhance transparency for enrollees like you. Knowing what’s new helps you stay ahead and make more confident healthcare decisions.

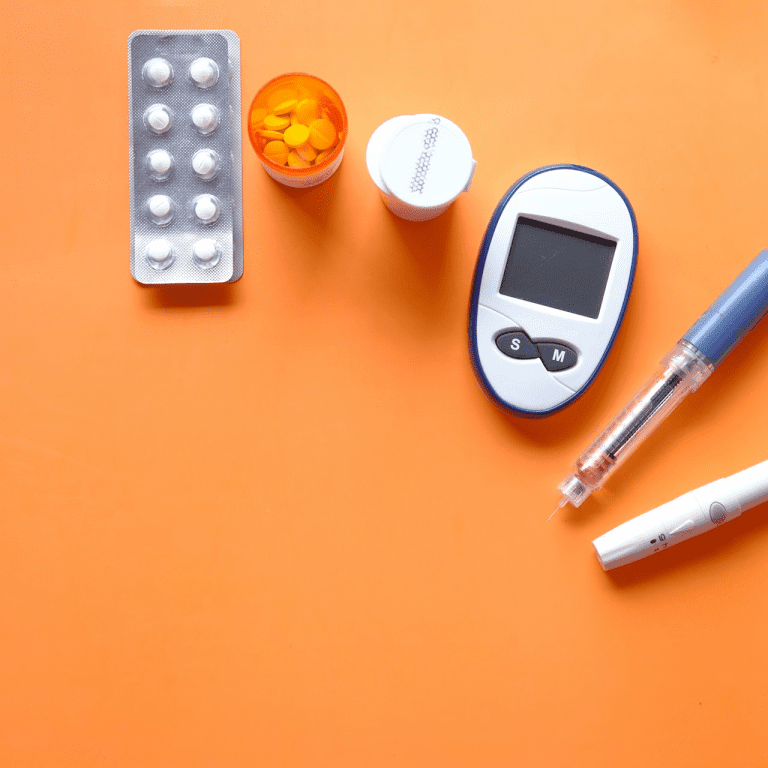

The Prescription Drug Out-of-Pocket Cap

One of the most significant changes for 2025 is the introduction of a $2,000 annual cap on out-of-pocket costs for prescription drugs under Medicare Part D. This adjustment eliminates the catastrophic phase that previously required continued cost-sharing.

What This Means for You:

-

Once you spend $2,000 on covered prescription drugs, your plan covers the rest for the year.

-

You no longer need to worry about ongoing coinsurance payments after reaching this threshold.

-

This cap applies regardless of whether you reach it early in the year or later.

A New Way to Pay: The Medicare Prescription Payment Plan

In 2025, Medicare offers a new payment option that lets you spread your drug costs over the year instead of paying large amounts all at once. This option, known as the Medicare Prescription Payment Plan, can reduce the burden of sudden expenses.

Key Details:

-

Available to all Part D enrollees who aren’t receiving low-income subsidies.

-

Allows you to pay monthly instead of up-front at the pharmacy.

-

Enrollment in this option is voluntary, but must be requested during specific windows.

If you face high drug costs early in the year, this plan gives you more financial control without sacrificing access to needed medications.

Adjustments to Medicare Part B Costs

Every year, Medicare Part B premiums and deductibles adjust to reflect healthcare cost trends. For 2025:

-

The standard monthly premium is $185.

-

The annual deductible has increased to $257.

These amounts may be higher depending on your income. If you are subject to an Income-Related Monthly Adjustment Amount (IRMAA), your premium will increase accordingly. Staying aware of these figures helps you budget for doctor visits, outpatient services, and durable medical equipment.

What’s New for Medicare Advantage Plans in 2025

Medicare Advantage (Part C) plans continue to evolve. In 2025, while the number of plans has slightly decreased, most still include supplemental benefits such as vision, dental, and fitness memberships. However, there are three main changes to be aware of:

1. Drug Cost Integration

Many Medicare Advantage plans now incorporate the $2,000 Part D out-of-pocket cap into their plan design, offering more predictable drug costs.

2. Mid-Year Notifications

From June 30 to July 31, you will receive a personalized notice showing which supplemental benefits you haven’t used in the first half of the year. This is meant to encourage you to take full advantage of your plan.

3. Reduction in Non-Medical Benefits

Compared to 2024, fewer plans offer over-the-counter benefits and transportation services in 2025. This may influence how you evaluate plans during the fall Open Enrollment period.

Enrollment Timelines to Keep in Mind

Understanding when you can enroll or make changes to your Medicare plan is crucial. In 2025, the following periods remain in place:

-

Initial Enrollment Period (IEP): Starts 3 months before you turn 65, includes your birthday month, and ends 3 months after.

-

General Enrollment Period (GEP): January 1 to March 31 each year. Coverage begins July 1.

-

Medicare Advantage Open Enrollment Period (MA-OEP): January 1 to March 31. Switch Advantage plans or return to Original Medicare.

-

Annual Enrollment Period (AEP): October 15 to December 7. Make changes to Medicare Advantage or Part D plans. New coverage starts January 1.

-

Special Enrollment Periods (SEPs): Triggered by life events like moving or losing employer coverage.

Being aware of these windows ensures that you don’t miss the opportunity to adjust your coverage if your needs change.

Updates to Medicare Part A Hospital Costs

For inpatient hospital stays under Medicare Part A, the 2025 updates are as follows:

-

Inpatient hospital deductible: $1,676 per benefit period

-

Coinsurance for days 61-90: $419 per day

-

Lifetime reserve day coinsurance: $838 per day

-

Skilled nursing facility (SNF) coinsurance (days 21-100): $209.50 per day

These costs apply if you are admitted to a hospital or SNF. Reviewing these figures can help you plan for potential hospitalization expenses.

Changes to Supplemental Benefits in Medicare Advantage

In 2025, the availability of certain supplemental benefits has declined:

-

Only 73% of Medicare Advantage plans offer over-the-counter allowances, compared to 85% in 2024.

-

Transportation benefits have dropped to 30%, down from 36% in the previous year.

While these benefits are non-medical, they can still influence your decision. You’ll want to compare plans carefully during Open Enrollment.

Understanding the Medicare Out-of-Pocket Maximums

In 2025, Medicare Advantage plans must follow certain maximum out-of-pocket (MOOP) limits for in-network and out-of-network services:

-

In-network MOOP: $9,350

-

Combined MOOP (in-network and out-of-network): $14,000

Once you hit these limits, your plan covers 100% of eligible services for the rest of the year. Keep in mind these limits exclude drug costs, which are now subject to the separate $2,000 cap under Part D.

Enhanced Focus on Preventive Services

Medicare continues to emphasize preventive care to support early detection and chronic disease management. These services are still available with no deductible or coinsurance when provided by a participating provider.

Covered preventive services include:

-

Annual wellness visits

-

Screenings for cancer, diabetes, and cardiovascular disease

-

Vaccinations like flu, hepatitis B, and shingles

Using these benefits can help you maintain better health and avoid costly interventions later.

Telehealth and Remote Care Options in 2025

Medicare still covers telehealth services in 2025, particularly for mental health, primary care follow-ups, and chronic condition management. While temporary pandemic-era expansions have ended, many virtual care options remain accessible.

Covered telehealth services may include:

-

Behavioral health counseling

-

Remote evaluations and consultations

-

Certain check-ins and follow-ups

You should verify whether your provider offers telehealth and if the service qualifies for Medicare reimbursement.

Be Aware of the Annual Notice of Change

Every fall, you receive an Annual Notice of Change (ANOC) if you’re enrolled in a Medicare Advantage or Part D plan. This document outlines any changes in:

-

Premiums and deductibles

-

Copayments and coinsurance

-

Drug formulary or covered medications

-

Supplemental benefits

Review it carefully during the Annual Enrollment Period. Any updates in the ANOC take effect on January 1 of the following year.

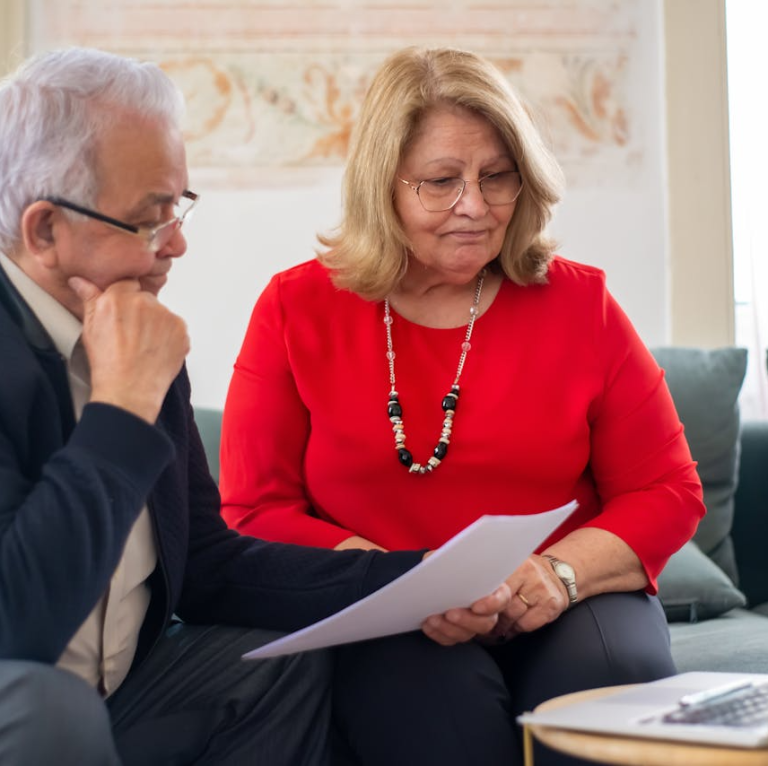

Why These Changes Matter for You

These new Medicare adjustments are not just numbers on a page—they affect your healthcare experience. From how much you pay for prescriptions to the availability of supplemental services, staying current means making better-informed decisions.

If you’re uncertain about how these changes impact your coverage, or if your plan still meets your needs, it’s wise to consult someone with expertise. A licensed agent listed on this website can provide guidance tailored to your situation.