Key Takeaways

-

The highest-rated Medicare Advantage plans are not always the best fit for your needs. Benefits vary widely, and understanding what’s actually covered is more important than chasing a five-star rating.

-

Important 2025 updates include changes in prescription drug coverage, out-of-pocket limits, and the continued integration of supplemental benefits. Reviewing these updates before enrolling is essential.

What Makes a Medicare Advantage Plan “Best” Is Often Misunderstood

If you’re preparing to enroll in a Medicare Advantage plan this year, you’re likely coming across the phrase “best plans” more often than you’d like. But it’s important to ask: best for whom? Medicare Advantage plans, also known as Part C, bundle your Medicare Part A and B benefits, and usually Part D, into one plan. But they also vary dramatically in costs, coverage limits, and network rules.

Even plans with top ratings might not meet your personal health needs or cover your preferred doctors and medications. This makes plan comparison not just helpful but necessary.

Understanding CMS Star Ratings in 2025

Each year, the Centers for Medicare & Medicaid Services (CMS) reviews and rates Medicare Advantage plans on a scale of 1 to 5 stars. These ratings are based on over 40 quality measures, such as:

-

Preventive care services

-

Chronic condition management

-

Member complaints and disenrollments

-

Customer service

While 5-star plans are considered top-tier, a high rating doesn’t automatically mean the plan will suit your health situation. A 3.5-star plan may be a better fit if it includes your doctors, lower costs, and essential benefits.

Keep in mind that plan ratings can change annually. The 2025 star ratings were released during the fall of 2024, just ahead of the Open Enrollment Period, and reflect performance metrics from the prior year.

The Real Features You Should Compare in 2025

When you shop for Medicare Advantage plans in 2025, consider more than just ratings. Focus on these core plan features:

Network Access

Medicare Advantage plans often use provider networks, such as HMOs or PPOs. If you have specific doctors or specialists you want to continue seeing, check that they are in the plan’s network. Out-of-network care is either restricted or more expensive, especially in HMO plans.

Out-of-Pocket Maximums

In 2025, the CMS cap for in-network out-of-pocket spending on Medicare Advantage plans is $9,350. Some plans have lower limits. It’s crucial to understand your potential costs if you face major medical events.

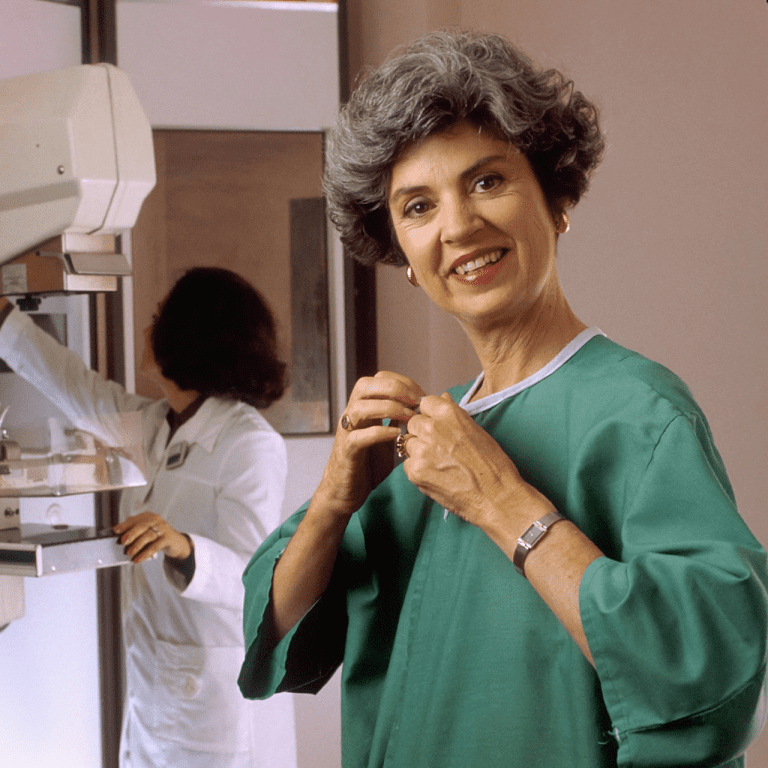

Prescription Drug Coverage

Most Medicare Advantage plans include Part D drug coverage, but formularies differ. You must check:

-

Whether your medications are covered

-

Which tier your drugs fall under

-

The copay or coinsurance amounts

Also, 2025 brings a major benefit: the out-of-pocket cap on prescription drugs is now limited to $2,000 annually under Part D. After you hit this limit, you won’t pay more for covered medications.

Prior Authorization Rules

Some services—like MRIs, hospital stays, or skilled nursing care—require prior approval. Plans differ in how quickly they process these requests and in what they approve. Make sure you’re comfortable with these restrictions.

Supplemental Benefits

Many plans advertise extra perks like dental, vision, hearing, or wellness programs. In 2025, over-the-counter benefits and transportation to medical appointments are still offered, but the number of plans offering them has decreased. Don’t assume these are included—check specifics.

2025 Plan Changes That May Affect Your Choice

You should never assume that a plan you liked in 2024 remains the same in 2025. Several important updates could affect your coverage:

-

New prescription drug out-of-pocket limit: The annual cap is now $2,000, eliminating the coverage gap phase known as the donut hole.

-

Mid-Year Supplemental Benefits Notification: Between June 30 and July 31, plans must notify you of unused supplemental benefits to encourage their use.

-

Reduced plan offerings in some counties: While there are still many choices, the total number of plans nationwide has slightly decreased from 2024. Rural areas may see more limited availability.

Enrollment Periods and Deadlines

Timing matters. Here are the main 2025 enrollment periods:

Initial Enrollment Period (IEP)

This is your first opportunity to enroll in Medicare, beginning three months before your 65th birthday, including your birth month, and ending three months after. You can join a Medicare Advantage plan once enrolled in Part A and Part B.

Annual Enrollment Period (AEP)

From October 15 to December 7, you can switch, drop, or enroll in a Medicare Advantage plan. Any changes made during this time take effect on January 1, 2026.

Medicare Advantage Open Enrollment Period

From January 1 to March 31, if you’re already enrolled in a Medicare Advantage plan, you can switch to a different Advantage plan or go back to Original Medicare. This window allows for one change only.

Common Mistakes to Avoid

Ignoring the Fine Print

Star ratings, plan brochures, and advertisements are helpful, but always check the official Summary of Benefits and Evidence of Coverage. These documents explain limits, exclusions, and what is and isn’t covered.

Choosing Based on Perks Alone

Free fitness memberships and dental cleanings sound attractive, but they shouldn’t drive your decision. Evaluate the core healthcare benefits first: provider access, prescription costs, and chronic care support.

Forgetting to Review Your Annual Notice of Change

Your current plan sends an Annual Notice of Change (ANOC) each fall. It outlines changes to your benefits, costs, and coverage for the coming year. If you skip reviewing this document, you risk missing important updates that could raise your out-of-pocket costs.

Medicare Advantage vs. Original Medicare: A Quick Comparison

| Feature | Medicare Advantage | Original Medicare |

|---|---|---|

| Provider Network | Limited (HMO/PPO) | Any provider that accepts Medicare |

| Prescription Drug Coverage | Usually included | Requires separate Part D plan |

| Out-of-Pocket Limit (2025) | Up to $9,350 | No cap unless you add Medigap |

| Premiums | Varies | Standard Part B premium applies |

| Supplemental Benefits | Frequently included | Rare or not included |

How to Compare Plans the Smart Way

Step 1: Make a List of Needs

Include your current doctors, prescriptions, medical conditions, and the type of coverage you’ve used most in the past year.

Step 2: Check Plan Finder Tools

Use official Medicare tools or consult a licensed agent listed on this website to help you understand what options fit your criteria.

Step 3: Review Star Ratings Carefully

Look beyond the stars. Focus on the metrics that matter to you, such as chronic condition management or customer service.

Step 4: Estimate Total Annual Costs

Don’t just look at premiums. Add in copays, deductibles, prescription costs, and out-of-pocket maximums.

Step 5: Confirm Network Access

Call your doctor’s office directly to ensure they participate in the plan’s network. Don’t rely on online directories alone.

Why Talking to a Licensed Agent Can Make a Difference

Choosing a Medicare Advantage plan is a major healthcare decision. Licensed agents can:

-

Walk you through the fine print

-

Help you compare multiple plans side-by-side

-

Explain cost breakdowns based on your situation

-

Help you stay updated on 2025 policy changes

You’re not alone in this process. Getting guidance ensures that the plan you choose aligns with your health needs, financial situation, and long-term goals.

Take Time to Pick the Right Medicare Advantage Plan This Year

In 2025, there’s no such thing as a one-size-fits-all Medicare Advantage plan. Plan options continue to evolve, and your needs may have changed too. What worked last year may no longer be sufficient. Star ratings are useful, but they should be only one part of your decision-making process.

Whether it’s finding a plan that covers your medications, avoids prior authorization headaches, or includes supplemental benefits you’ll actually use, your focus should always be on how the plan supports your specific needs.

Take time to research, ask questions, and if necessary, get in touch with a licensed agent listed on this website who can walk you through your choices step-by-step.