Key Takeaways

-

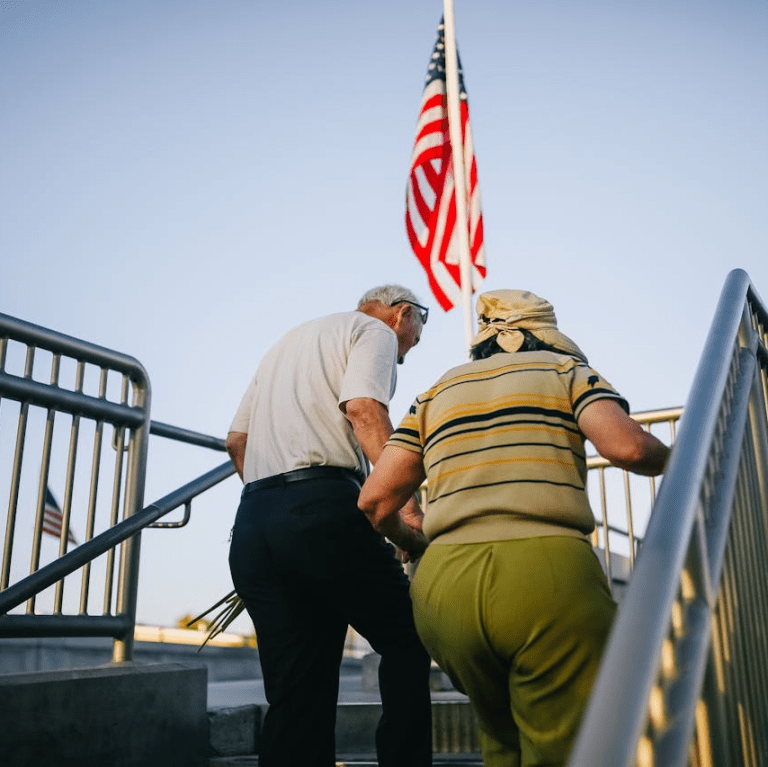

In 2025, your Medicare benefits can vary widely depending on your zip code, especially when it comes to extra services, out-of-pocket costs, and eligibility for certain types of plans.

-

Staying informed about how your local market affects your Medicare options is essential before enrolling or making any plan changes during the annual enrollment periods.

Why Zip Codes Matter in Medicare

When you enroll in Medicare, you’re joining a federal program. But even though it’s federal, your local area plays a significant role in what coverage options are available to you. That’s because many Medicare options—especially Medicare Advantage and prescription drug plans—are offered through regional contracts. Your zip code determines which plans operate in your area and what extra benefits they may include.

What Remains the Same Everywhere

Before we get into what varies, it’s helpful to know what stays consistent across all zip codes:

-

Original Medicare (Part A and Part B) is the same throughout the United States. Part A covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health care. Part B includes doctor visits, outpatient care, medical supplies, and preventive services.

-

Part A and Part B premiums and deductibles are set at the national level. In 2025, the standard monthly premium for Part B is $185, and the annual deductible is $257.

-

Eligibility rules for Medicare don’t change based on your zip code. You’re generally eligible if you’re 65 or older or if you qualify due to disability.

What Changes Based on Your Zip Code

Here’s where your location starts to matter a lot more.

Medicare Advantage Availability

Medicare Advantage (Part C) plans are offered by private companies contracted with Medicare. These plans must cover at least what Original Medicare does, but they often offer extra benefits—like dental, vision, hearing, transportation, and fitness programs.

-

Zip code-based networks: Carriers only offer plans in select counties or zip codes. You might have dozens of choices in a metro area and only a handful in a rural region.

-

Provider networks vary: Even if a plan has the same name in different regions, the doctors and hospitals in the plan’s network may differ significantly.

Prescription Drug Plans (Part D)

-

Formularies differ by location: Each Part D plan has its own formulary (list of covered drugs), and not all plans are available in all areas.

-

Pharmacy networks vary: Your zip code affects whether your local pharmacy is considered in-network or preferred, which in turn influences your copay amounts.

Plan Benefits and Extras

-

Supplemental benefits depend on local contracts. For instance, some plans in one county may offer dental and vision, while the same plan in another county might not.

-

Over-the-counter (OTC) allowances and meal deliveries may only be available in specific zip codes, based on service area agreements.

Premiums and Cost Sharing

Even though Medicare sets rules and minimum standards, individual plans determine their own cost-sharing structures. This includes:

-

Monthly premiums (which you must pay in addition to Part B)

-

Copayments and coinsurance

These numbers can vary substantially depending on where you live, due to regional healthcare costs and plan competition.

How ZIP Codes Impact Special Eligibility and Programs

Your zip code also plays a role in determining eligibility for certain assistance programs or plan types:

Medicare Savings Programs (MSPs)

These state-administered programs help pay for Medicare premiums and, in some cases, deductibles and coinsurance. Because they’re run at the state level, the income and asset limits for qualifying can differ, and sometimes the availability or type of assistance can vary between zip codes.

Medicaid Dual Eligibility

If you qualify for both Medicare and Medicaid, the type of support you receive may vary depending on your location. Some states operate under federal waivers to deliver managed care services differently in various counties.

Dual Eligible Special Needs Plans (D-SNPs) are not available nationwide. Even if you qualify, there may be none in your county or zip code.

Extra Help (Low-Income Subsidy for Part D)

This federal program helps lower prescription drug costs, but the plans that coordinate with Extra Help vary. Depending on your zip code, the number of plans you can enroll in with $0 deductibles or reduced drug costs under Extra Help can change.

Why Urban vs. Rural Makes a Big Difference

In 2025, disparities between urban and rural Medicare offerings remain notable:

-

Urban areas generally have more plan options and greater access to supplemental benefits like dental, vision, and hearing.

-

Rural areas may have fewer Medicare Advantage plans or none at all, leading many beneficiaries in those regions to stay on Original Medicare and add a separate Part D plan.

-

Telehealth and service access in rural regions is expanding, but you may still face limitations in provider availability.

When ZIP Code Becomes Most Important: Enrollment and Changes

Your zip code plays a critical role during Medicare enrollment periods:

Initial Enrollment Period (IEP)

Your 7-month IEP starts three months before the month you turn 65 and ends three months after. During this time, the plan choices available to you are based on your residence zip code.

Annual Enrollment Period (AEP)

From October 15 to December 7 each year, you can switch, drop, or join Medicare Advantage or Part D plans. You’ll need to check which plans are available in your zip code for the upcoming year.

Special Enrollment Periods (SEPs)

A change in zip code often triggers a Special Enrollment Period. If you move to a different service area or state:

-

You may lose access to your current plan.

-

You’ll have a 2-month window to join a new plan in your new location.

-

If you’re moving into or out of an institution, like a nursing facility, the rules may be different.

What to Do If You’re Moving

If you change your permanent residence, notify Medicare and your plan provider promptly. This ensures you don’t experience a lapse in coverage. Before moving:

-

Check plan availability in your new zip code.

-

Review networks to make sure your preferred doctors and pharmacies are included.

-

Compare benefits offered in the new service area.

State-Level Differences That Trick You Into Thinking It’s Federal

It’s easy to assume Medicare is uniform across the country, but the state you live in can affect more than you might expect:

-

State Medicaid programs differ widely in eligibility, benefits, and cost-sharing rules.

-

State pharmaceutical assistance programs offer varying levels of help with drug costs.

-

Some states have Medicare Advantage or D-SNP pilots that are unavailable elsewhere.

Always verify with your local State Health Insurance Assistance Program (SHIP) or talk to a licensed agent who understands your local Medicare landscape.

How to Find Out What’s Available in Your Zip Code

The best way to find accurate, personalized Medicare information for your area is to:

-

Visit Medicare’s Plan Finder tool and enter your zip code.

-

Contact your local SHIP office.

-

Speak with a licensed agent listed on this website for up-to-date and local advice.

Making the Most of Your Medicare Coverage—Wherever You Live

Choosing the right plan depends not just on your health needs but also on where you live. Understanding how zip code influences plan availability, costs, provider networks, and benefits can help you avoid costly surprises.

As we move through 2025, policy changes and regional developments continue to shape what Medicare looks like from one zip code to another. Whether you’re preparing to enroll for the first time or considering a plan switch, staying informed about how your local area impacts your Medicare options can help you make the best possible decision.

Get Help Based on Where You Live

Your Medicare benefits in 2025 depend not only on what you’re eligible for but also on where you live. Whether you’re comparing plans or preparing to move, having a local expert in your corner can make all the difference.

To explore the Medicare options available in your zip code, get in touch with a licensed agent listed on this website for personalized guidance and support.