Key Takeaways

-

Enrolling in Medicare Part D when you’re first eligible can protect you from lifelong penalties—even if you’re not currently taking prescription drugs.

-

Skipping Part D now may leave you vulnerable to unexpected future costs and limit your options later.

Why Medicare Part D Is Still Relevant in 2025

You might think Medicare Part D, which covers prescription drugs, doesn’t concern you if you’re not taking any medications. But in 2025, that assumption can cost you more than just money—it could reduce your flexibility, leave you without essential coverage when you need it most, and penalize you for years to come.

Part D isn’t just for people currently taking medication. It’s an insurance plan meant to shield you from high drug costs later and prevent gaps in coverage. Even if you have no prescriptions now, your situation can change quickly—and if you wait to enroll, the consequences may follow you for life.

What Medicare Part D Actually Covers

Medicare Part D helps pay for:

-

Prescription drugs you fill at a pharmacy

-

Certain vaccines not covered by Part B

-

Insulin and related supplies (under Part D coverage rules)

-

Medications on a plan’s formulary (list of covered drugs)

In 2025, many plans continue to offer coverage through an integrated drug formulary that includes both generic and brand-name medications. These formularies vary from plan to plan, and it’s crucial to check if a future medication you might need is listed.

Enrollment Timing Makes All the Difference

You first become eligible to enroll in a Part D plan when you turn 65 or when you first enroll in Medicare. This seven-month period includes:

-

3 months before the month you turn 65

-

The month you turn 65

-

3 months after that month

If you delay without other creditable drug coverage, you’ll likely face a permanent late enrollment penalty.

What Is Creditable Coverage?

Creditable coverage means the prescription drug coverage you have (such as through an employer or union) is expected to pay, on average, at least as much as standard Medicare Part D coverage. If you have creditable coverage and lose it later, you’ll have a Special Enrollment Period to sign up for Part D without penalty—but you must act promptly.

The Late Enrollment Penalty Adds Up

The late enrollment penalty in 2025 still works the same way it has in prior years:

-

It’s 1% of the national base premium for each full month you were eligible but didn’t enroll.

-

This penalty gets added to your premium every month—for life.

While the national base premium changes each year, the penalty is permanent. Even if your future medication costs remain low, the penalty alone can become a significant ongoing cost.

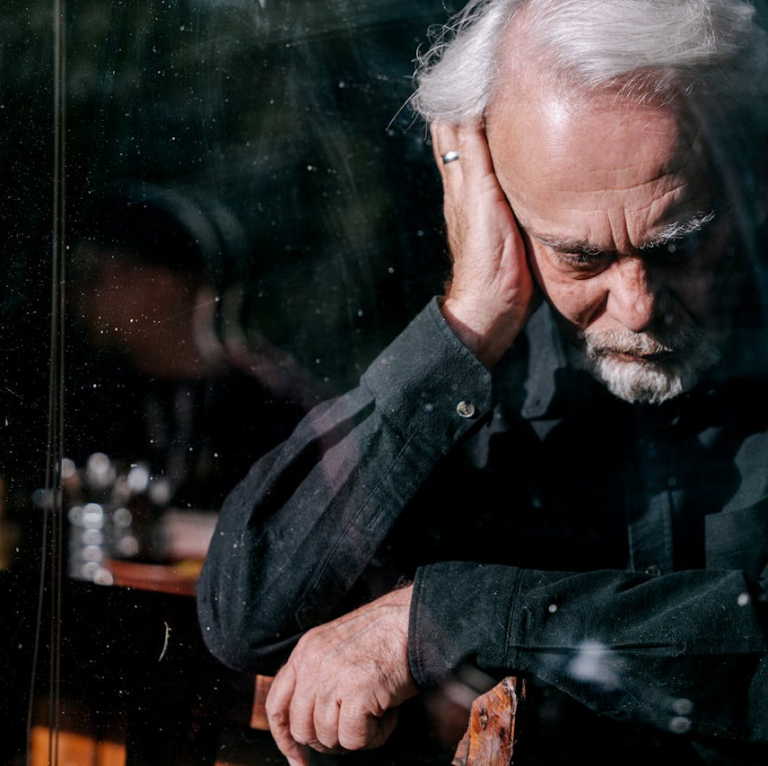

You Can’t Predict the Future—But You Can Prepare

Your health can change suddenly. One diagnosis, injury, or unexpected event may require expensive medications. If you’re not enrolled in Part D and don’t have creditable coverage, you may have to wait until the next annual enrollment period to get a plan—and that could mean paying full cost for prescriptions in the meantime.

Planning for the future means protecting yourself now. Skipping Part D because you’re healthy today assumes you’ll always remain healthy, and that’s not a safe bet.

The Value of Peace of Mind

Even if you don’t use it immediately, Part D offers protection:

-

Emergency readiness — you’re covered if new prescriptions are suddenly needed

-

Avoidance of financial shocks — brand-name drugs and specialty medications can be extremely expensive without coverage

-

Stable access to medications — helps you avoid having to delay treatment due to affordability

For many people, that peace of mind is worth the modest monthly cost of having a plan in place.

Annual Enrollment and Plan Flexibility

Every year, you can review and change your Part D coverage during Medicare’s Annual Enrollment Period, which runs from October 15 to December 7. This allows you to:

-

Switch to a different Part D plan

-

Add or drop drug coverage

-

Adjust your plan based on changing needs or newly prescribed medications

If you’re already enrolled, this period is your chance to make sure your plan still fits you. If you’re not enrolled and missed your Initial Enrollment Period, this may be your next chance—but the late enrollment penalty will still apply unless you had creditable coverage.

Common Misunderstandings About Part D

Let’s clear up a few common misconceptions that cause people to skip Part D:

“I Don’t Take Any Medications”

That’s your situation today. It might not be the case tomorrow. Part D is forward-looking—it’s about having coverage before you need it, not after.

“I’ll Just Enroll Later If I Need It”

You can’t enroll anytime. Unless you qualify for a Special Enrollment Period, you must wait for the Annual Enrollment Period. That could leave you paying full price for medications for months.

“I’ll Pay Out of Pocket—It’s Cheaper”

In the short term, maybe. But if your needs change, the cost of paying full price for just one brand-name or specialty drug can easily exceed the monthly cost of a Part D plan. Plus, you’d still have to deal with the late enrollment penalty.

“I Have VA, TRICARE, or Employer Coverage”

You might be covered—but only if that coverage is considered creditable. It’s important to check each year and maintain proof of coverage.

Why 2025 Brings New Incentives to Get Part D

In 2025, Medicare Part D introduces a significant improvement: an annual $2,000 cap on out-of-pocket drug costs. Once your total spending (including deductible, copays, and coinsurance) hits this cap, your plan pays 100% of your covered drug costs for the rest of the year.

This change removes the previous structure’s catastrophic phase and helps protect people who suddenly face high drug costs. Even if you don’t use expensive drugs now, knowing this protection is there offers long-term security.

Also starting in 2025, you’ll have the option to spread out your drug costs across the year with the Medicare Prescription Payment Plan. This can make budgeting for medications much easier if and when you ever need them.

How to Evaluate Part D Options—Even if You’re Healthy

When you’re healthy, choosing a Part D plan might feel like overkill. But some plans offer:

-

Low premiums (but remember, prices vary—no $0 mentions here)

-

Coverage for common preventive vaccines

-

Pharmacy networks you already use

-

Protection against future high costs

Look for plans that offer flexibility, a reliable formulary, and favorable terms should your health needs change. You may not need extensive coverage now, but having some coverage is smarter than having none.

When You Can Skip Part D Safely

You might be able to delay Part D without penalty if:

-

You’re covered by employer drug coverage that’s creditable

-

You have creditable coverage through the VA or TRICARE

-

You qualify for Extra Help, a Medicare program that lowers drug costs

However, make sure your coverage is officially creditable. Request written proof each year to avoid misunderstandings that can lead to penalties later.

Enrollment Isn’t Automatic—And Mistakes Are Costly

Unlike Part A and B, which may enroll you automatically depending on your circumstances, Part D is never automatic. You must actively enroll in a plan. And doing so at the right time makes all the difference.

If you miss the Initial Enrollment Period and don’t qualify for a Special Enrollment Period, you’ll have to wait for the Annual Enrollment Period—and you may have a gap in coverage while facing penalties.

Making the Smart Move—Even If You Don’t Feel the Urgency

It’s tempting to ignore something that doesn’t seem urgent. But Medicare Part D is a classic case where delay can hurt you. A low-cost plan today can prevent:

-

Lifelong penalties

-

High out-of-pocket expenses later

-

Limited access to essential medications

Being proactive now gives you flexibility, peace of mind, and protection. It’s a smart decision even if you’re in perfect health.

Protect Yourself Now to Avoid Future Regrets

Even if you’re not filling prescriptions today, Medicare Part D coverage can spare you steep penalties and unexpected costs down the road. Plans in 2025 come with enhanced protections like the $2,000 out-of-pocket cap and more predictable costs.

Don’t wait until a health event forces your hand. Enroll in a suitable plan when first eligible, or review your options during the next enrollment period if you’re already on Medicare.

For support tailored to your needs, get in touch with a licensed agent listed on this website. They can walk you through your Part D choices and help you find a plan that fits—even if you don’t take medications now.