Key Takeaways:

- Understanding the basics of Medicare helps in making an informed decision.

- Knowing the difference between Original Medicare and Medicare Advantage is crucial for choosing the right plan.

Say Goodbye to Medicare Confusion: How to Choose the Right Plan

Navigating Medicare can be a daunting task, but with a clear understanding of the basics and the options available, you can choose the plan that best suits your needs. This guide aims to simplify the complexities of Medicare and provide practical tips for selecting the right plan.

What’s the Deal with Medicare?

Medicare is a federal health insurance program primarily for people aged 65 and older, but it also covers certain younger people with disabilities and those with End-Stage Renal Disease. Understanding the different parts of Medicare is essential to choosing the right plan.

Medicare is divided into four parts: Part A, Part B, Part C, and Part D. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Part C, also known as Medicare Advantage, is an all-in-one alternative to Original Medicare and includes additional benefits like vision, hearing, and dental. Part D covers prescription drugs.

Breaking Down Medicare Parts: Easy as Pie

To make an informed decision, it’s important to understand what each part of Medicare offers and how it can benefit you.

Part A (Hospital Insurance)

Part A covers inpatient hospital care, including a semi-private room, meals, general nursing, and drugs as part of your inpatient treatment. It also covers skilled nursing facility care, hospice care, and home health care. Most people don’t pay a premium for Part A because they paid Medicare taxes while working.

Part B (Medical Insurance)

Part B helps cover medically necessary services like doctors’ services and outpatient care. It also covers preventive services, clinical research, ambulance services, durable medical equipment, mental health, and some outpatient prescription drugs. Part B requires a monthly premium, which is adjusted based on your income.

Part C (Medicare Advantage)

Medicare Advantage (Part C) plans are offered by private insurance companies approved by Medicare. These plans provide all your Part A and Part B coverage and may offer additional benefits such as dental, vision, and wellness programs. They often include Part D (prescription drug coverage) as well. Medicare Advantage plans have a cap on out-of-pocket costs for covered services, which can provide financial protection.

Part D (Prescription Drug Coverage)

Part D adds prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans. These plans are offered by insurance companies and other private companies approved by Medicare. Each plan can vary in cost and drugs covered.

Original Medicare vs. Medicare Advantage: What’s the Difference?

Choosing between Original Medicare and Medicare Advantage is a crucial decision. Here are the key differences to help you decide:

Original Medicare

- Flexibility: You can see any doctor or specialist that accepts Medicare.

- No Network Restrictions: There are no network restrictions, giving you more freedom to choose your healthcare providers.

- Separate Drug Plan: You need to enroll in a separate Part D plan for prescription drug coverage.

- Supplemental Coverage: You can purchase Medigap (Medicare Supplement Insurance) to help cover out-of-pocket costs like deductibles and copayments.

Medicare Advantage

- All-in-One Coverage: Combines Part A, Part B, and usually Part D coverage into one plan.

- Additional Benefits: May offer extra benefits like dental, vision, hearing, and wellness programs.

- Network Restrictions: You may need to use healthcare providers who are in the plan’s network and service area.

- Out-of-Pocket Maximum: Includes an out-of-pocket maximum, providing financial protection against high medical costs.

How to Pick the Best Plan for You

Selecting the best Medicare plan involves assessing your health needs, budget, and preferences. Here are steps to guide you:

Assess Your Health Needs

Consider your current health status and any chronic conditions you have. Think about the type and frequency of medical services you need. If you require regular visits to specialists or have ongoing prescriptions, these factors will influence your choice.

Budget Considerations

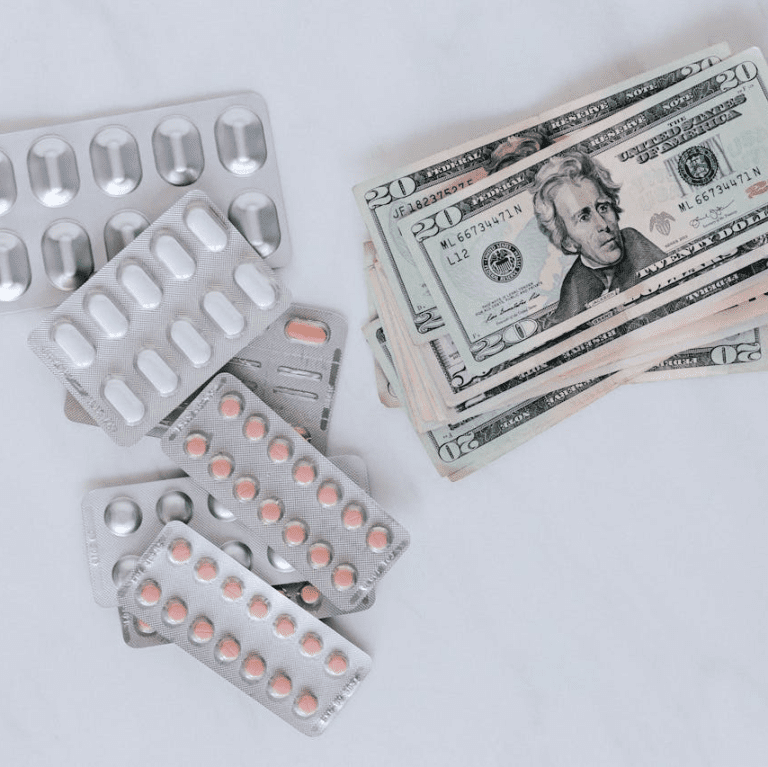

Evaluate the costs associated with each plan, including premiums, deductibles, copayments, and out-of-pocket maximums. Compare these costs with your budget to determine which plan is affordable for you.

Coverage Options

Review the coverage details of each plan. Ensure that the plan covers the services and medications you need. If you opt for Medicare Advantage, check if your preferred doctors and hospitals are in the plan’s network.

Additional Benefits

Consider any additional benefits offered by Medicare Advantage plans. If dental, vision, or hearing coverage is important to you, look for plans that provide these services.

Convenience and Access

Think about the convenience and accessibility of the plan. If you travel frequently, Original Medicare might offer more flexibility as it doesn’t restrict you to a network. Conversely, if you prefer coordinated care with a network of providers, a Medicare Advantage plan could be a better fit.

Common Medicare Mistakes to Avoid

When navigating Medicare, it’s easy to make mistakes that could impact your coverage and costs. Here are common pitfalls to avoid:

Missing Enrollment Deadlines

Failing to enroll in Medicare when you’re first eligible can result in late enrollment penalties and gaps in coverage. Be sure to sign up during your Initial Enrollment Period, which starts three months before you turn 65 and ends three months after your 65th birthday.

Overlooking Plan Changes

Medicare plans can change annually. Benefits, costs, and covered medications can vary, so it’s important to review your plan during the Annual Enrollment Period (AEP) from October 15 to December 7. Compare your current plan with other options to ensure it still meets your needs.

Ignoring Out-of-Pocket Costs

Don’t focus solely on premiums. Consider all out-of-pocket costs, including deductibles, copayments, and coinsurance. Understanding the total cost of a plan helps you avoid unexpected expenses.

Not Understanding Coverage Limits

Medicare doesn’t cover everything. For example, Original Medicare doesn’t cover long-term care, most dental care, and eye exams related to prescribing glasses. Be aware of these limitations and consider supplemental insurance if needed.

Getting Help: Where to Turn for Advice

Choosing the right Medicare plan can be overwhelming, but you don’t have to do it alone. Here are resources to help you make an informed decision:

Licensed Insurance Agents

Licensed insurance agents can provide personalized assistance and help you understand your options. They can compare different plans and guide you through the enrollment process.

State Health Insurance Assistance Program (SHIP)

SHIP offers free, unbiased counseling to Medicare beneficiaries. Counselors can help you understand your coverage options, compare plans, and assist with enrollment.

Medicare.gov

The official Medicare website provides comprehensive information about Medicare plans, coverage, and enrollment. Use the Medicare Plan Finder tool to compare plans in your area.

Community Resources

Local senior centers, health clinics, and community organizations often offer Medicare education programs and assistance. These resources can provide valuable support and information.

Annual Enrollment Period: Don’t Miss It

The Annual Enrollment Period (AEP) is a critical time for Medicare beneficiaries. From October 15 to December 7, you can make changes to your Medicare coverage. Here’s what you can do during AEP:

Review Your Current Coverage

Assess your current Medicare plan to determine if it still meets your needs. Consider any changes in your health, finances, and coverage needs.

Compare Plans

Use the Medicare Plan Finder to compare other plans available in your area. Look at costs, coverage, and benefits to find a plan that suits you better.

Enroll or Switch Plans

During AEP, you can switch from Original Medicare to Medicare Advantage, or vice versa. You can also change Medicare Advantage plans or enroll in a Part D prescription drug plan.

Avoid Last-Minute Decisions

Don’t wait until the last minute to make changes. Take your time to review and compare your options to ensure you make the best decision for your health and budget.

Staying Informed: Tips for Ongoing Medicare Success

Staying informed about your Medicare coverage is essential for maximizing your benefits and avoiding issues. Here are tips for ongoing success:

Keep Up with Changes

Medicare rules and plans can change annually. Stay updated by reviewing the Medicare & You handbook, visiting Medicare.gov, and attending informational sessions.

Monitor Your Coverage

Regularly review your Medicare Summary Notice (MSN) or Explanation of Benefits (EOB) to ensure your claims are processed correctly. Report any discrepancies or errors to Medicare.

Use Preventive Services

Take advantage of Medicare’s preventive services, such as screenings, vaccines, and wellness visits. These services can help you stay healthy and detect potential issues early.

Ask for Help

If you have questions or need assistance, don’t hesitate to ask for help. Reach out to licensed insurance agents, SHIP counselors, or the Medicare helpline for guidance.

Make Informed Medicare Choices

Choosing the right Medicare plan is a significant decision that impacts your healthcare and finances. By understanding your options, avoiding common mistakes, and seeking help when needed, you can make an informed choice that meets your needs and provides peace of mind.

Contact Information:

Email: [email protected]

Phone: 8305559012