Key Takeaways

- Understanding the new Medicare copayments can help you better manage your healthcare budget.

- Planning ahead and employing cost-saving strategies are essential for minimizing out-of-pocket expenses.

Managing Your Healthcare Costs with New Medicare Copayments

Navigating the complexities of Medicare can be challenging, especially with changes in copayments. In 2024, it’s important to understand these changes and how they might impact your healthcare expenses. By being informed and proactive, you can effectively manage your healthcare costs and make the most out of your Medicare benefits.

Understanding the New Medicare Copayments

Medicare copayments are the fixed amounts you pay for healthcare services, typically at the time of service. In 2024, these copayments have undergone several changes that could affect your out-of-pocket expenses. Understanding these adjustments is the first step in managing your healthcare costs.

Medicare is divided into different parts, each with its own copayment structure:

- Part A covers hospital stays, skilled nursing facility care, hospice, and some home health care services.

- Part B covers outpatient care, preventive services, ambulance services, and durable medical equipment.

- Part D covers prescription drugs.

Changes in copayments can occur for various reasons, including inflation, changes in healthcare costs, and legislative updates. Staying informed about these changes can help you anticipate and prepare for potential increases in your healthcare expenses. By understanding how each part of Medicare works and what changes are expected, you can better plan your healthcare budget for the year.

How These Changes Affect Your Wallet

Understanding how these copayment changes will impact your wallet is crucial. Copayments are just one part of your overall healthcare expenses, which also include premiums, deductibles, and coinsurance. Here’s a breakdown of how copayment changes could affect your budget:

Hospital Stays

Medicare Part A covers inpatient hospital stays, but you are responsible for a portion of the costs. With new copayment rates, you might see an increase in what you pay per day after a certain number of days in the hospital. This can add up, especially if you require extended hospital care. For example, the cost for a hospital stay beyond a specific number of days could significantly increase, affecting those with chronic conditions requiring longer hospitalizations.

Outpatient Services

Part B copayments for outpatient services, including doctor’s visits and preventive care, may also change. These changes could mean higher out-of-pocket costs for routine visits and necessary medical equipment. Even minor changes in copayments for frequent services can lead to noticeable increases in your annual healthcare spending. Regular visits to specialists, tests, and other outpatient procedures will need to be factored into your budget.

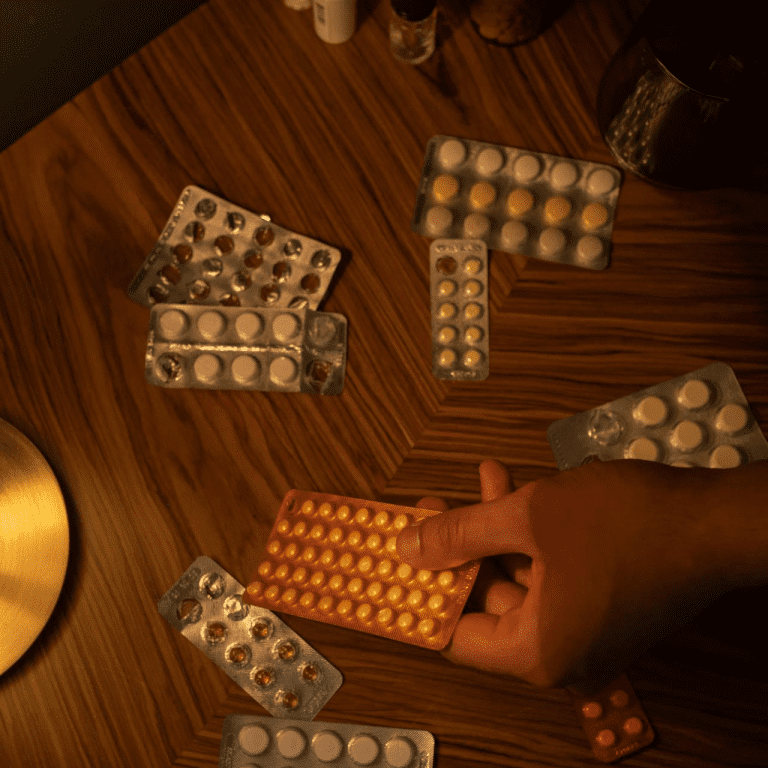

Prescription Drugs

Part D covers prescription medications, but copayments can vary widely based on your plan and the medications you need. Changes in copayment rates can affect how much you pay at the pharmacy, potentially impacting your budget significantly if you rely on multiple prescriptions. If you have a chronic condition that requires regular medication, it’s particularly important to monitor these changes and seek cost-saving options like generics or mail-order services.

Tips for Keeping Healthcare Costs Down

Keeping healthcare costs manageable requires a proactive approach. Here are some practical tips to help you navigate the new Medicare copayments and minimize your expenses:

Review Your Plan Annually

Medicare plans can change yearly. Reviewing your plan annually during the open enrollment period can help you stay informed about changes in copayments, premiums, and coverage. Consider switching plans if another offers better coverage or lower costs. It’s also a good time to reassess your health needs and whether your current plan still meets them effectively.

Utilize Preventive Services

Medicare offers several preventive services at no additional cost, which can help you avoid more significant health issues and expenses down the line. Take advantage of these services to maintain your health and catch potential problems early. Regular screenings, vaccinations, and wellness visits can detect issues before they become serious and costly.

Choose Generic Medications

When possible, opt for generic medications instead of brand-name drugs. Generics are typically less expensive and just as effective. Discuss with your doctor whether a generic alternative is available for your prescriptions. This simple change can lead to substantial savings over time, especially if you take multiple medications.

Stay In-Network

Using healthcare providers within your plan’s network can significantly reduce your out-of-pocket costs. Out-of-network providers often charge higher rates, and your plan may cover less of the cost. Always check whether your provider is in-network before scheduling appointments or procedures.

Seek Financial Assistance Programs

Various programs can help with Medicare costs, including Medicaid, Medicare Savings Programs, and pharmaceutical assistance programs. Check if you qualify for any of these programs to help reduce your expenses. These programs can offer substantial relief, especially if you have limited income or high medical expenses.

Budgeting for Medicare in 2024

Creating a budget for your healthcare expenses is a vital step in managing costs effectively. Here are some steps to help you plan your budget for 2024:

Estimate Your Annual Healthcare Costs

Start by estimating your annual healthcare costs, including premiums, copayments, deductibles, and out-of-pocket expenses. Look at your expenses from the previous year as a guide. Factor in any expected changes in your health or new treatments that might be necessary.

Build an Emergency Fund

Unexpected medical expenses can arise at any time. Having an emergency fund specifically for healthcare costs can provide a financial cushion and prevent stress. Aim to save at least a few months’ worth of healthcare expenses to cover unexpected costs.

Track Your Expenses

Keep track of your healthcare expenses throughout the year. This will help you stay within your budget and identify areas where you can cut costs. Regularly review your spending to ensure you’re not overspending on unnecessary services or medications.

Plan for Prescription Costs

If you take regular medications, factor in the copayments and any potential changes in your Part D plan. This will help you avoid surprises at the pharmacy. Consider options like mail-order pharmacies, which can sometimes offer lower costs and added convenience.

Smart Ways to Save on Healthcare

Saving on healthcare costs is about being strategic and informed. Here are some smart ways to save:

Compare Medicare Plans

Different Medicare plans offer various benefits and cost structures. Use online tools to compare plans and find the one that best meets your needs at the lowest cost. Consider both the monthly premium and the copayment structures when making your decision.

Schedule Regular Check-Ups

Regular check-ups can help catch health issues early, potentially reducing the need for more expensive treatments later. Preventive care is often covered at no additional cost under Medicare. Regular visits to your primary care doctor can help you stay on top of your health.

Use Telehealth Services

Telehealth services have become more popular and can be a convenient and cost-effective alternative to in-person visits for certain conditions. Check if your plan covers telehealth and use it when appropriate. This can save both time and money, particularly for routine consultations.

Take Advantage of Wellness Programs

Many Medicare plans offer wellness programs that can help you stay healthy and manage chronic conditions. These programs can include fitness classes, nutrition counseling, and more. Participating in these programs can improve your overall health and reduce medical costs.

Stay Healthy

Maintaining a healthy lifestyle can prevent many health issues and reduce your healthcare costs. Eat a balanced diet, exercise regularly, and avoid unhealthy habits like smoking. A healthy lifestyle can lead to fewer doctor visits and lower medication costs.

Planning Ahead: Copayment Strategies

Planning ahead is key to managing your healthcare costs effectively. Here are some strategies to help you navigate the new copayment landscape:

Understand Your Benefits

Make sure you understand the details of your Medicare coverage, including what services are covered and what copayments apply. This knowledge can help you avoid unexpected expenses. Be sure to read all communications from Medicare and your plan provider to stay updated.

Schedule Expensive Procedures Early

If you know you need an expensive procedure, try to schedule it early in the year. This way, you can reach your deductible sooner and reduce out-of-pocket costs for subsequent services. Planning procedures at the start of the year can also help manage your budget more effectively.

Negotiate Medical Bills

Don’t be afraid to negotiate medical bills with your providers. Sometimes, they are willing to lower the cost or offer a payment plan to help you manage expenses. Always review your bills for errors and discuss any discrepancies with your healthcare provider.

Use Health Savings Accounts

If you have a high-deductible health plan, consider using a Health Savings Account (HSA) to save for medical expenses. HSAs offer tax advantages and can help you set aside money for future healthcare costs. Contributions to an HSA can be a wise financial move to prepare for unexpected medical expenses.

Stay Informed

Healthcare regulations and Medicare policies can change. Stay informed about any new developments that could affect your coverage and costs. Subscribe to newsletters, follow reputable sources, and consult with licensed insurance agents when needed. Keeping up with changes ensures you can adjust your plan as necessary to maintain optimal coverage and cost-effectiveness.

Taking Control of Your Healthcare Costs

Taking control of your healthcare costs with the new Medicare copayments in 2024 is possible with the right strategies and knowledge. By understanding the changes, budgeting effectively, and utilizing available resources, you can minimize your out-of-pocket expenses and ensure you get the care you need without financial strain. Being proactive and informed allows you to navigate the complexities of Medicare with confidence and peace of mind.

Contact Information:

Email: [email protected]

Phone: 3365551234