Key Takeaways

- Understanding the key dates for Medicare enrollment in 2024 ensures you don’t miss out on crucial benefits.

- Proper preparation and awareness of tips can make the Medicare enrollment process smooth and stress-free.

The Inside Scoop on Medicare Enrollment 2024: Key Dates and Tips

Navigating the Medicare enrollment process can seem daunting, especially with ever-changing regulations and timelines. Understanding the key dates and essential tips for Medicare enrollment in 2024 is crucial to ensure you receive the benefits you need without any hiccups. This guide aims to simplify the process, providing you with the necessary information to make informed decisions.

Why You Should Care About Medicare Enrollment Dates

Medicare enrollment dates are critical because they determine when you can sign up for or change your Medicare coverage. Missing these dates can lead to delayed coverage and potential penalties. Medicare provides essential health benefits for those over 65 and certain younger individuals with disabilities, making it imperative to be aware of enrollment periods to avoid gaps in your healthcare coverage.

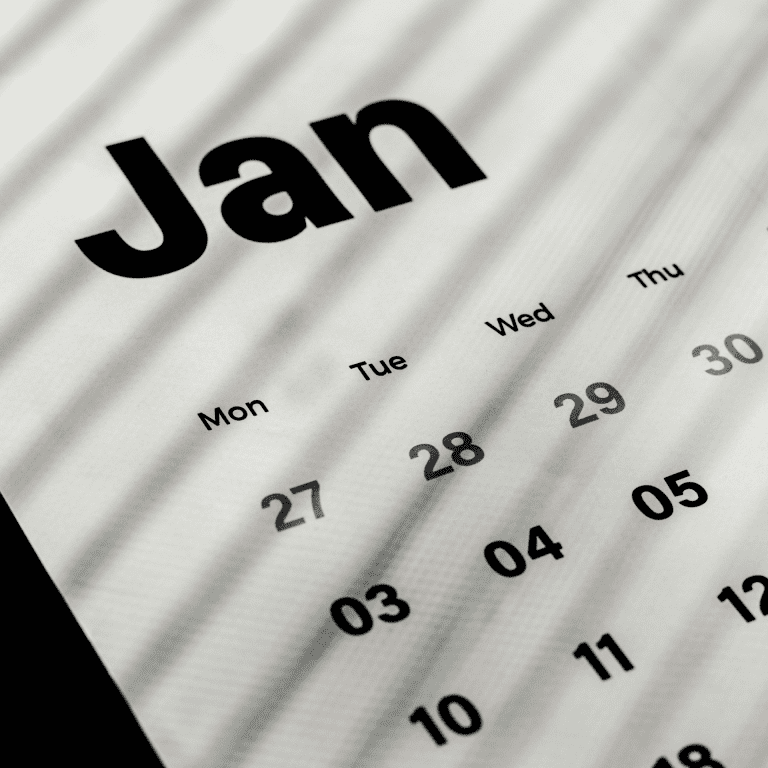

Mark Your Calendar: Important Dates for Medicare in 2024

Here are the key Medicare enrollment dates you need to remember for 2024:

- Initial Enrollment Period (IEP): This seven-month window includes the three months before your 65th birthday, the month of your birthday, and the three months following your birthday. For example, if your birthday is in June, your IEP runs from March 1 to September 30.

- General Enrollment Period (GEP): If you missed your IEP, you could enroll during the GEP, which runs from January 1 to March 31 each year. Coverage begins on July 1 of that year.

- Annual Enrollment Period (AEP): From October 15 to December 7, this period allows you to make changes to your Medicare Advantage or Medicare Part D plans. Changes made during the AEP take effect on January 1 of the following year.

- Medicare Advantage Open Enrollment Period (MA OEP): From January 1 to March 31, if you are already enrolled in a Medicare Advantage plan, you can switch to another Medicare Advantage plan or return to Original Medicare.

Understanding these dates ensures you won’t miss out on critical enrollment periods, helping you avoid late enrollment penalties and ensuring continuous coverage.

What Happens if You Miss the Enrollment Window?

Missing your Medicare enrollment window can have several consequences, including:

- Late Enrollment Penalties: If you don’t sign up for Medicare Part B when you’re first eligible, you may have to pay a late enrollment penalty for as long as you have Medicare. This penalty can increase your premiums by 10% for each full 12-month period you could have had Part B but didn’t sign up.

- Delayed Coverage: Missing the IEP or GEP means your coverage won’t start until the next enrollment period, leaving you without Medicare coverage for several months.

- Limited Enrollment Options: Outside of the specified enrollment periods, your options for enrolling in or changing Medicare plans are limited, potentially locking you into a less-than-ideal plan until the next enrollment window.

To avoid these pitfalls, mark your calendar with the key dates and start preparing for enrollment well in advance.

Tips to Breeze Through Medicare Enrollment

Here are some tips to help you navigate the Medicare enrollment process smoothly:

- Start Early: Begin researching and preparing for Medicare enrollment at least six months before your 65th birthday. This gives you ample time to understand your options and gather the necessary documentation.

- Review Your Current Coverage: If you already have health insurance, review your current coverage and compare it with Medicare plans. This helps you decide whether to keep your existing coverage or switch to Medicare.

- Use Online Tools: The Medicare website offers various tools and resources to help you compare plans, estimate costs, and find providers. Utilize these tools to make informed decisions.

- Consult a Licensed Insurance Agent: Licensed insurance agents can provide personalized advice and answer your questions about Medicare. They can help you understand the different parts of Medicare and which options are best suited to your needs.

- Stay Organized: Keep all your Medicare-related documents and correspondence in one place. This includes your Medicare card, letters from Medicare, and any notes from conversations with licensed insurance agents.

How to Prepare for Medicare Enrollment Season

Preparation is key to a smooth Medicare enrollment experience. Here are some steps to help you get ready:

- Gather Necessary Documents: Ensure you have all the required documents, such as your birth certificate, Social Security card, and any other relevant medical records.

- Understand Your Health Needs: Make a list of your current medications, doctors, and any ongoing health conditions. This will help you choose a plan that covers your specific needs.

- Budget for Healthcare Costs: Consider your current and future healthcare expenses, including premiums, deductibles, and out-of-pocket costs. This will help you choose a plan that fits your budget.

- Review Plan Options: Research the different Medicare plans available in your area, including Medicare Advantage, Medicare Part D (prescription drug coverage), and Medigap (Medicare Supplement Insurance) plans. Compare the benefits and costs of each option.

- Attend Information Sessions: Many communities offer Medicare information sessions or workshops. These events provide valuable information and allow you to ask questions in person.

The Do’s and Don’ts of Signing Up for Medicare

Navigating Medicare enrollment can be tricky. Here are some do’s and don’ts to keep in mind:

Do’s

- Do Sign Up on Time: Ensure you enroll during your IEP to avoid late penalties and gaps in coverage.

- Do Review Your Options Annually: Your healthcare needs may change, so it’s important to review your Medicare options every year during the AEP.

- Do Seek Help if Needed: If you’re unsure about any aspect of Medicare, don’t hesitate to seek help from a licensed insurance agent or Medicare counselor.

- Do Keep Records: Maintain accurate records of your Medicare enrollment, plan details, and any correspondence with Medicare or insurance providers.

Don’ts

- Don’t Ignore Deadlines: Missing enrollment deadlines can lead to penalties and delayed coverage.

- Don’t Assume Medicare Covers Everything: Medicare doesn’t cover all medical expenses. Understand what is and isn’t covered to avoid surprises.

- Don’t Rush the Process: Take your time to research and compare plans. Rushing can lead to mistakes and suboptimal choices.

- Don’t Rely Solely on Friends’ Advice: While friends and family may offer advice, remember that everyone’s healthcare needs are different. Make decisions based on your own research and needs.

Avoid Common Pitfalls During Medicare Enrollment

Medicare enrollment can be fraught with potential pitfalls. Here are some common ones to avoid:

- Procrastination: Waiting until the last minute to enroll can lead to missed deadlines and rushed decisions. Start early to give yourself plenty of time.

- Overlooking Plan Details: Each Medicare plan has different benefits and costs. Pay attention to the details to ensure the plan you choose meets your needs.

- Ignoring Annual Notices: Medicare plans send out Annual Notice of Change (ANOC) letters each fall. These letters outline any changes to your plan for the upcoming year. Review these notices carefully to understand how your plan may be changing.

- Not Understanding the Different Parts of Medicare: Medicare has several parts, each covering different aspects of healthcare. Make sure you understand what each part covers and how they work together.

- Forgetting to Reevaluate: Your health and financial situation may change over time. Reevaluate your Medicare coverage annually to ensure it still meets your needs.

Need Help? Here’s Where to Get Support

If you need assistance with Medicare enrollment, there are several resources available:

- Medicare Website: The official Medicare website (Medicare.gov) offers a wealth of information, tools, and resources to help you understand and navigate the enrollment process.

- Licensed Insurance Agents: These professionals can provide personalized advice and help you compare different Medicare plans.

- State Health Insurance Assistance Programs (SHIPs): SHIPs offer free, unbiased counseling to Medicare beneficiaries. They can help you understand your options and make informed decisions.

- Local Senior Centers: Many senior centers offer workshops and information sessions on Medicare enrollment. These events can provide valuable information and allow you to ask questions in person.

- Friends and Family: While your healthcare needs are unique, discussing Medicare with friends and family can provide additional insights and support.

Getting Ready for Medicare Enrollment

Medicare enrollment may seem overwhelming, but with the right information and preparation, you can navigate the process with confidence. Remember to mark your calendar with the key dates, start your research early, and seek help if needed. By following these tips, you can ensure you choose the right Medicare plan for your needs and avoid common pitfalls.

Contact Information:

Email: [email protected]

Phone: 9045552345