Key Takeaways

-

Medicare Part C may offer attractive extra benefits like dental, vision, and hearing, but these additions often come with limitations on provider networks, service areas, and higher out-of-pocket costs.

-

Understanding the true cost of these extras involves looking beyond what’s advertised and examining how coverage works in practice, especially during medical emergencies or while traveling.

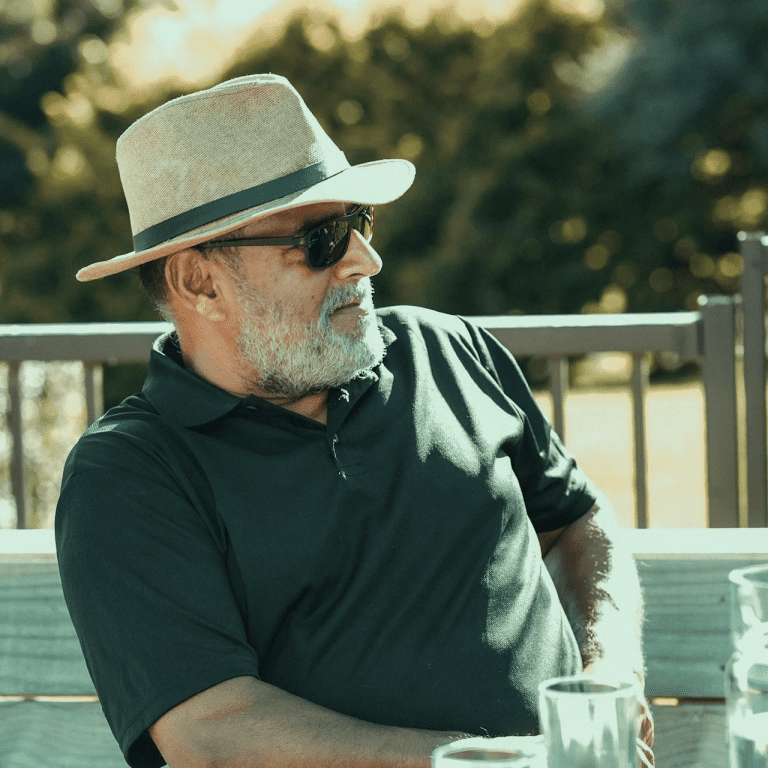

Why Part C Looks So Appealing at First

Medicare Part C, also known as Medicare Advantage, bundles your hospital (Part A), medical (Part B), and usually prescription drug coverage (Part D) into one plan. In addition to this coverage, many plans offer extra benefits you won’t find in Original Medicare, such as:

-

Dental cleanings and fillings

-

Routine eye exams and eyeglasses

-

Hearing aids

-

Wellness and fitness programs

-

Transportation to medical appointments

-

Over-the-counter item allowances

These benefits are marketed as major upgrades to Original Medicare, and on the surface, they are. But when you take a closer look, each added benefit comes with restrictions that can affect how useful they are when you actually need them.

What You Trade for Those Extras

While the additional perks sound impressive, enrolling in Medicare Part C often means giving up some flexibility and financial predictability. Here’s what you trade for those added features:

1. Limited Provider Networks

Unlike Original Medicare, which lets you see any provider that accepts Medicare, Part C plans usually rely on a managed care model:

-

HMO plans generally require you to use doctors and hospitals within the plan’s network.

-

PPO plans allow some out-of-network care, but you’ll typically pay more.

This means you could lose access to your current specialists or preferred hospitals unless they participate in the plan’s network. And even if they’re in-network now, that could change from year to year.

2. Service Area Restrictions

Each Medicare Advantage plan operates within a defined geographic area. You must live in the plan’s service area to enroll, and your benefits are usually limited to that region.

If you travel frequently or split your time between states, this can be a major drawback. Emergency care is always covered, but routine and follow-up care might not be if you’re outside your plan’s area.

3. Prior Authorization and Referrals

Most Medicare Part C plans require prior authorization for services like imaging, surgeries, or even certain medications. This means you’ll need your plan’s approval before receiving the service. It’s an extra step that can delay treatment.

In many cases, you’ll also need a referral from your primary care doctor to see a specialist. This gatekeeping adds complexity and can slow down your care.

4. Cost-Sharing Surprises

Even though Medicare Advantage plans must follow Medicare rules, their cost structures are very different from Original Medicare. Instead of a standard 20% coinsurance for most services, Part C plans often have:

-

Copayments that vary by service

-

Tiered specialist fees

-

Facility-based pricing (e.g., higher copays at certain hospitals)

These differences can make it harder to predict your out-of-pocket costs, especially if your health needs change mid-year.

5. Changing Benefits Annually

Medicare Advantage plans are allowed to change their benefits, networks, and costs every year. Even if a plan works well for you this year, it might not next year. You’ll need to review your Annual Notice of Change each fall to make sure your plan still meets your needs for the following year.

Are the Extra Benefits Really Worth It?

The promise of extra benefits is often what draws people to Medicare Part C. But are they truly valuable?

Dental Benefits

While many Part C plans include dental coverage, it often comes with strict limitations:

-

Coverage may only include cleanings and exams, not more costly procedures like root canals or crowns.

-

There’s usually an annual benefit cap—sometimes just a few hundred dollars.

You might still face high out-of-pocket costs for anything beyond basic care.

Vision and Hearing

Vision benefits usually cover routine exams and some portion of eyeglasses or contact lenses. Hearing benefits may include exams and partial coverage for hearing aids. But like dental, these perks typically come with capped allowances.

OTC Allowances and Gym Memberships

Some plans offer monthly allowances for over-the-counter medications or fitness memberships. These perks are nice to have, but they shouldn’t be the primary reason to choose a plan. They’re only useful if you actually use them—and can use them where you live.

Comparing Part C to Original Medicare with Medigap

It’s important to compare Medicare Advantage with Original Medicare plus a Medigap (supplemental) policy. Medigap plans help cover costs that Original Medicare doesn’t, such as:

-

Coinsurance

-

Deductibles

-

Foreign travel emergency care

Medigap doesn’t offer dental, vision, or hearing extras, but it gives you nationwide access to any provider that accepts Medicare and fewer hoops to jump through.

Here’s how the trade-offs generally play out:

| Feature | Medicare Part C | Original Medicare + Medigap |

|---|---|---|

| Extra Benefits | Yes | No |

| Provider Access | Network only | Any Medicare provider |

| Out-of-Pocket Predictability | Variable, plan dependent | High predictability |

| Service Area Limitations | Yes | No |

| Prior Authorization Needed | Frequently | Rarely |

| Monthly Premium | May be lower | Usually higher |

The right choice depends on what matters more to you—upfront benefits or long-term flexibility and cost transparency.

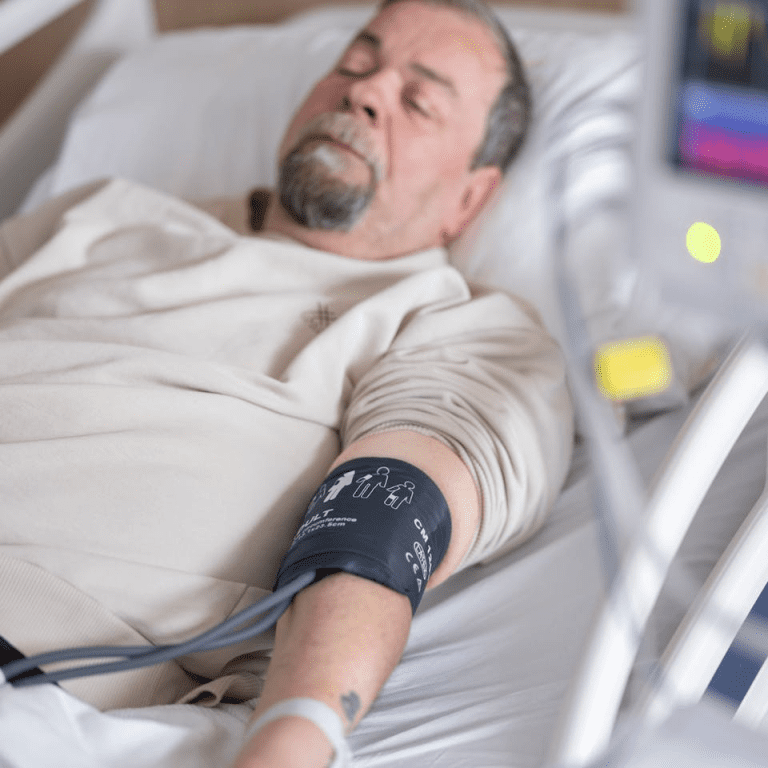

Emergency Situations Highlight the Weak Spots

Part C plans work well for many enrollees—until there’s an emergency or chronic condition that requires complex care. You may face:

-

Delays in approvals for needed services

-

Out-of-network charges if hospitalized outside your plan area

-

Denials for follow-up treatments not deemed medically necessary by your plan

This is why reviewing your plan’s network and policies is critical before enrolling.

How Medicare Rules Affect What Plans Can Offer

In 2025, Medicare continues to allow Advantage plans to offer a wide range of supplemental benefits. However, these benefits must be:

-

“Primarily health-related”

-

Reasonably allocated (e.g., not offering a benefit to one group that’s denied to others without reason)

CMS rules require plans to provide clear information about benefits, cost-sharing, and provider access—but the complexity still often leaves beneficiaries confused.

Each fall, the Medicare Open Enrollment Period (October 15 to December 7) gives you a chance to switch plans if your current one no longer fits. Take full advantage of this time to reassess your needs.

Don’t Let Extras Distract You from the Basics

It’s easy to get caught up in a flashy benefit list and miss how your core coverage actually works. Before enrolling in Medicare Part C, ask yourself:

-

Are your doctors in the plan’s network?

-

Will you need referrals or prior authorizations?

-

How does the plan cover care when you travel?

-

Are out-of-pocket maximums reasonable for your budget?

-

Are the extra benefits truly useful to you?

A plan that looks great on paper might not deliver the peace of mind you need in practice.

What to Focus on When Choosing Coverage

Don’t just look at what you’re gaining—look at what you might be giving up. Some of the most important features of a Medicare plan are:

-

Flexibility to choose providers and locations

-

Consistency in annual out-of-pocket costs

-

Accessibility to specialists and urgent care without red tape

-

Clarity in how services are authorized and billed

In the end, Medicare Part C can be a suitable choice for some—but only if you understand its limitations and are prepared for the potential trade-offs.

Take a Step Toward Confident Coverage Choices

Understanding the true cost of Medicare Part C extras means weighing the full picture—not just the perks. If you want help reviewing your options, comparing coverage types, or deciding whether to switch plans, speak with a licensed agent listed on this website. They can help guide you based on your location, medical needs, and budget.