Key Takeaways

-

Medicare is not free. Even if you paid into the system for decades, you will still face ongoing costs for premiums, deductibles, coinsurance, and uncovered services.

-

In 2025, changes like the $2,000 prescription drug cap and increased Part B premiums are reshaping what you actually pay, but out-of-pocket costs still add up fast.

The Illusion of “Free” Medicare

Many people enter retirement assuming Medicare will cover most, if not all, of their healthcare needs at little to no cost. That assumption quickly falls apart when the bills start rolling in. While it’s true that you’ve paid into Medicare throughout your working life, enrolling and using the program still involves substantial out-of-pocket costs.

Even the term “premium-free Part A” can be misleading. It only applies if you or your spouse paid Medicare taxes for at least 40 quarters (10 years). If not, you pay a monthly premium. And that’s just the beginning.

Your Costs Begin with the Basics

Part A: Hospital Insurance

If you qualify for premium-free Part A, you still face the following costs in 2025:

-

Inpatient hospital deductible: $1,676 per benefit period

-

Coinsurance: $419 per day for days 61-90, $838 per day after that, using lifetime reserve days

-

Skilled nursing facility coinsurance: $209.50 per day for days 21-100

These figures are not annual but based on benefit periods, which reset if you haven’t been in a hospital or skilled nursing facility for 60 days.

Part B: Medical Insurance

Everyone pays a monthly premium for Part B. In 2025, the standard premium is $185 per month. If your income exceeds certain thresholds, you may owe more under the Income-Related Monthly Adjustment Amount (IRMAA).

Other costs include:

-

Annual deductible: $257

-

Coinsurance: You typically pay 20% of the Medicare-approved amount for outpatient services, doctor visits, lab tests, durable medical equipment, and more

These costs apply year-round and don’t stop at a certain spending threshold.

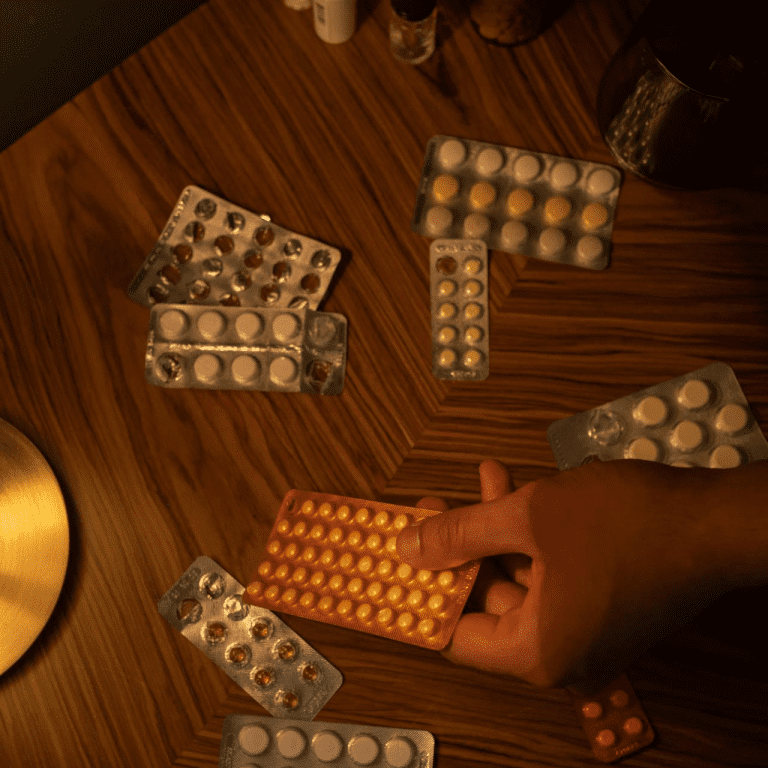

The Price Tag of Drug Coverage

Part D: Prescription Drug Plans

Prescription drug coverage under Medicare Part D comes with its own set of expenses:

-

Premiums: Vary by plan and income level

-

Deductible: Up to $590 in 2025

-

Copayments and coinsurance: Depend on the drug tier and plan

The good news for 2025 is the introduction of a $2,000 out-of-pocket cap for prescription drugs. Once you hit that threshold, your plan pays 100% for covered drugs for the rest of the calendar year. However, you still pay all your costs until reaching that cap.

What Medicare Still Doesn’t Cover

Despite being a broad program, Medicare leaves major gaps in coverage. These include:

-

Long-term care: Custodial care in a nursing home or assisted living isn’t covered

-

Dental care: Routine cleanings, dentures, and fillings are not included

-

Vision: Eye exams for glasses and contacts are excluded

-

Hearing: Most hearing aids and exams aren’t covered

-

Overseas care: Care outside the U.S. is generally not covered

These services must be paid out of pocket or through separate supplemental insurance.

Supplemental Insurance Isn’t Free Either

To reduce your out-of-pocket exposure, you might consider enrolling in supplemental coverage. While this can protect you from some Medicare gaps, it adds another layer of cost.

You’ll have to budget for additional monthly premiums, and depending on the plan, may still face deductibles, coinsurance, or provider network limitations. Supplemental insurance doesn’t replace Medicare but wraps around it, and your total costs often depend on your healthcare usage.

Income Matters More Than You Think

Your income directly affects what you pay for Medicare. The higher your income, the more you pay in premiums for both Part B and Part D through IRMAA. These adjustments are based on your modified adjusted gross income (MAGI) from two years prior. That means your 2023 tax return determines your 2025 premium bracket.

It’s not just about the numbers on paper. Even if your income has dropped due to retirement, you may still pay higher premiums until your updated tax returns reflect the change. You can request a reconsideration, but it requires formal documentation and approval.

Additional Costs That Sneak In

Beyond premiums and deductibles, Medicare costs can surprise you with a range of smaller but significant expenses:

-

Doctor and specialist copays if you choose Medicare Advantage or see non-participating providers

-

Emergency room or urgent care fees

-

Medical equipment replacement

-

Transportation to medical appointments

-

Therapies and rehabilitation sessions

Even preventive services, which are often touted as “free,” can lead to charges if the provider finds and treats a condition during the visit. That turns your preventive screen into a diagnostic service.

How Medicare Advantage Changes the Cost Landscape

Medicare Advantage (Part C) offers all-in-one plans that include Parts A, B, and usually D. However, these plans operate with their own structure of premiums, deductibles, copayments, and provider networks.

In 2025, many Advantage plans offer extra perks like vision, dental, and fitness benefits, but these do not eliminate out-of-pocket costs. You may still owe:

-

Monthly plan premiums (on top of your Part B premium)

-

Copayments for each service used

-

Annual out-of-pocket maximums that can exceed $9,000

While the cap may limit how much you spend, reaching it still requires significant usage and upfront cost-sharing.

Penalties That Raise Your Costs Over Time

Late enrollment in Medicare leads to long-term financial consequences:

-

Part B late enrollment penalty: 10% added to your premium for each 12-month period you delayed enrollment without other coverage

-

Part D penalty: 1% of the national base premium for every month you delayed enrollment

These penalties are permanent and increase the total cost of Medicare for the rest of your life.

You May Still Need Help with Daily Expenses

Medicare does not offer direct support for non-medical issues like food, housing, or home modifications. If you need in-home help with daily living but not skilled care, you’re on your own to pay for it.

Some programs may offer limited support through Medicaid or state-based services, but eligibility is based on income and assets. Even then, the coverage is often minimal and waitlists are common.

When Timing Matters Most

The decisions you make about when and how to enroll in Medicare can significantly affect your financial outcome:

-

Initial Enrollment Period: Begins three months before the month you turn 65 and ends three months after

-

General Enrollment Period: January 1 to March 31 each year if you missed your IEP

-

Special Enrollment Periods: Triggered by events like losing employer coverage

-

Annual Enrollment Period: October 15 to December 7 for changing plans

Missing these windows or choosing the wrong combination of coverage can expose you to higher premiums, penalties, or gaps in coverage.

Budgeting for the Real Cost of Medicare

It’s wise to build Medicare expenses into your retirement budget. Here’s what to consider:

-

Monthly premiums for Part B, Part D, and any supplemental coverage

-

Annual deductibles and coinsurance

-

Prescription costs up to the $2,000 cap

-

Services not covered by Medicare at all

-

Premium surcharges due to higher income

A realistic estimate of your annual healthcare costs should range between $5,000 and $10,000, depending on your health, income, and coverage choices.

Planning Ahead Saves Money and Stress

The biggest mistake is assuming Medicare takes care of everything automatically. In 2025, healthcare is one of the largest retirement expenses, and underestimating your Medicare costs can put your savings and lifestyle at risk.

Start by reviewing your health needs, medications, and expected income. Consider getting personalized help from someone who understands Medicare inside and out.

Getting Help Makes a Difference

Medicare rules are complex, and the costs continue to shift each year. If you’re unsure how to approach enrollment, coverage choices, or budgeting, you’re not alone. The smartest move you can make is to talk with someone who knows how the pieces fit together.

You can connect with a licensed agent listed on this website for one-on-one guidance about your Medicare costs and coverage options.