Key Takeaways

-

Your Annual Notice of Change (ANOC) outlines critical updates to your Medicare Advantage or Part D plan for the coming year. Ignoring it could result in unexpected costs or coverage gaps in 2025.

-

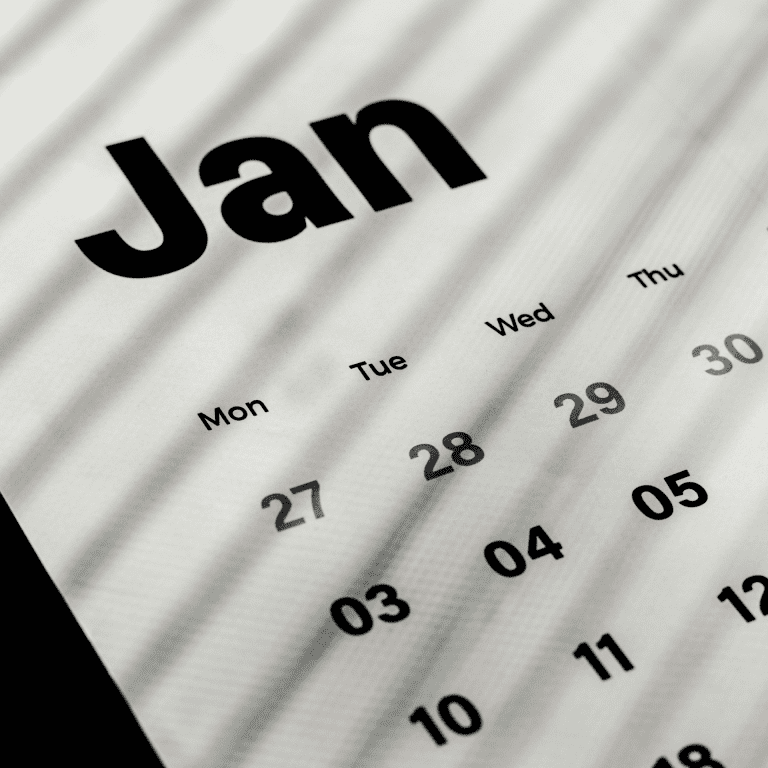

You receive your ANOC each September, giving you enough time to review changes and take action during Medicare Open Enrollment from October 15 to December 7.

What Is the Annual Notice of Change (ANOC)?

Each year, Medicare Advantage and Medicare Part D prescription drug plans send out a document called the Annual Notice of Change, or ANOC. This letter is not just another piece of mail—it’s an official document detailing changes to your current plan that will take effect on January 1 of the following year.

The ANOC includes updates on:

-

Monthly premiums

-

Deductibles and out-of-pocket maximums

-

Copayments and coinsurance amounts

-

Covered drugs (for Part D plans)

-

Provider networks and coverage rules

If you are enrolled in a Medicare Advantage or standalone Part D plan, you should receive your ANOC by September 30 every year. For 2025, this means you should have received your ANOC by the end of September 2024.

Why the ANOC Matters More Than You Think

Many people overlook the ANOC, assuming that no news means no changes. Unfortunately, that assumption can be costly. Plans change every year, and even minor adjustments can significantly affect your healthcare or finances.

Here’s why reading your ANOC is essential:

-

Costs Can Increase: Your monthly premium, deductible, or copayments may rise, even if you didn’t switch plans.

-

Coverage Can Change: Medications or services that were covered in 2024 might not be covered in 2025.

-

Provider Networks Can Shrink: A doctor or specialist you regularly visit may no longer be in your plan’s network.

-

New Rules May Apply: Plans often update prior authorization rules, step therapy requirements, or other service limitations.

When to Expect the ANOC

You can expect to receive your ANOC by mail or electronically by the end of September. Plans are required to send these notices each year to current enrollees. If you haven’t received it by early October, contact your plan directly.

After receiving your ANOC, use the period between October 1 and October 14 to review the document carefully. This gives you enough time to understand the changes before the Medicare Open Enrollment Period starts on October 15.

What to Look for in Your ANOC

When you receive your ANOC, review the following areas carefully:

1. Premium Changes

Even if the plan’s base premium looks the same, you should check for increases in:

-

Monthly premiums

-

Part D late enrollment penalties (if applicable)

-

IRMAA (Income-Related Monthly Adjustment Amount) for higher-income beneficiaries

2. Deductibles and Cost Sharing

These can change yearly and affect your out-of-pocket costs:

-

Annual medical or drug deductibles

-

Copayments for primary care and specialists

-

Coinsurance percentages for hospital stays and services

3. Prescription Drug Coverage

Changes in Part D plans can affect:

-

Covered medications (called the formulary)

-

Drug tiers and cost-sharing levels

-

Prior authorization or quantity limits

4. Provider Network

If you have a Medicare Advantage plan, make sure your:

-

Primary care physician is still in-network

-

Specialists and facilities remain covered

-

Preferred hospitals haven’t changed

5. Extra Benefits

Some Medicare Advantage plans include additional services like dental, vision, or hearing benefits. Review whether these:

-

Remain the same

-

Are reduced or eliminated

-

Require higher cost-sharing

How to Compare the ANOC With Other Plans

After reviewing your ANOC, it’s wise to see if other plans available in your area may offer better coverage or lower costs for 2025.

From October 15 to December 7, you can:

-

Switch Medicare Advantage plans

-

Return to Original Medicare and join a Part D plan

-

Enroll in a different Part D prescription drug plan

Use the Medicare Plan Finder tool or speak with a licensed agent listed on this website to compare your options.

What Happens If You Do Nothing?

If you’re happy with your current plan’s changes, you don’t need to take any action—your coverage will continue into 2025 automatically. But if your ANOC shows that your costs are increasing or your coverage is decreasing, and you do nothing, you could be left with:

-

Higher monthly premiums

-

Unexpected out-of-pocket costs

-

A plan that no longer meets your medical needs

Don’t Rely on Memory—Use a Checklist

Here’s a helpful checklist to make sure you review the key points in your ANOC:

-

Check if your monthly premium has increased compared to last year.

-

Confirm whether your annual deductible or other out-of-pocket costs have gone up.

-

Review the updated drug formulary to ensure your medications are still covered.

-

Make sure your primary care doctor and specialists are still in-network.

-

Look for any changes to extra benefits, such as dental, vision, or hearing services.

If you notice anything that raises concerns or seems unfamiliar, it’s a clear sign that you should consider reviewing other plan options for 2025.

Other Documents You Might Confuse With the ANOC

People sometimes mistake the ANOC for other annual mailings. Make sure you don’t confuse it with:

-

Evidence of Coverage (EOC): This is a longer, more detailed document outlining your plan’s rules and benefits. It often arrives around the same time as the ANOC.

-

Annual Notice of Creditable Coverage: For those with employer or union drug coverage, this notice states whether your coverage is as good as or better than Medicare’s standard.

The ANOC is unique because it focuses on what’s changing in your specific Medicare Advantage or Part D plan for the upcoming year.

What to Do If You Don’t Understand Something

If anything in your ANOC is unclear, don’t hesitate to get help. You can:

-

Call your plan’s customer service

-

Visit Medicare.gov for official guidance

-

Speak to a licensed agent listed on this website

Make sure you understand how your coverage will change before Open Enrollment ends on December 7.

Staying in Control of Your Coverage

Medicare decisions aren’t one-and-done. They require annual attention. The ANOC is your first signal that something is changing—and that it might be time to take action.

Use the weeks between receiving your ANOC and the end of Open Enrollment to decide whether to stay or switch. A small amount of effort can result in thousands saved or much better coverage.

Review Now—Decide Before December 7

You don’t have to become an insurance expert to protect yourself. All it takes is a careful read-through of your ANOC and a willingness to ask questions.

If you’re unsure whether your current plan is still the right fit for you in 2025, connect with a licensed agent listed on this website. They can walk you through your ANOC and help you compare plans during the Medicare Open Enrollment period.