Key Takeaways

-

Medicare Advantage plans often start off feeling like a good fit due to their bundled benefits, but they can become restrictive when your health needs or provider preferences change.

-

Limited provider networks and prior authorization rules in these plans may hinder timely access to care, especially if you travel or develop more complex health conditions.

What Makes Medicare Advantage Seem So Appealing Initially

When you’re first comparing your Medicare options, Medicare Advantage plans might seem like an obvious choice. They combine hospital (Part A), medical (Part B), and usually prescription drug coverage (Part D) into one plan. Many of them include extras like dental, vision, and fitness benefits. The streamlined structure looks easy to manage and cost-effective at first glance.

You also may be drawn in by the idea of managed care, where a plan coordinates your services. These features create the impression of a plan that does more for you with less hassle.

But these benefits can mask the plan’s built-in limitations, especially when it comes to provider choice, service area restrictions, and prior authorization requirements.

The Hidden Limits of Provider Networks

One of the first major limitations that you may encounter is the provider network. Most Medicare Advantage plans operate as HMOs or PPOs. If you’re in an HMO, you generally need to stay within the network for all your care unless it’s an emergency. Even PPOs charge higher costs if you go out-of-network.

This might be fine if your doctors are in-network and you’re not planning to move. But if you travel frequently, split time in different states, or want to see a specific specialist who isn’t in your network, your flexibility is suddenly gone. You may need to:

-

Switch providers altogether

-

Travel back to your primary service area for care

-

Pay out-of-pocket for out-of-network services

Even within the same city, you could find that some top specialists or facilities aren’t available under your plan.

Prior Authorization Rules Can Delay Care

Medicare Advantage plans often require prior authorization for services that Original Medicare does not. This includes advanced imaging, hospital stays, outpatient surgeries, and even some cancer treatments.

In 2025, CMS continues efforts to reduce delays caused by prior authorization, but the process still affects many enrollees. A study published in 2024 showed that nearly 1 in 3 enrollees in Medicare Advantage experienced delays in needed care due to authorization rules.

These rules can be especially frustrating when your condition changes quickly or you need prompt treatment. Even if your doctor believes a service is medically necessary, your plan has the final say.

Flexibility Suffers When Your Health Needs Change

At the time you enroll, you may feel healthy and assume that your current needs will stay about the same. But health can change quickly. If you’re diagnosed with a chronic illness, need rehabilitation, or want to explore treatment options out of state, Medicare Advantage’s tight network and prior authorization model may limit your choices.

In contrast, Original Medicare offers a broader range of access:

-

You can see any doctor or hospital that accepts Medicare nationwide.

-

You don’t need prior authorization for most services.

-

Supplement plans, if added, can help reduce out-of-pocket costs.

When you need more freedom to see specialists or receive complex treatments, these differences become more noticeable.

Moving or Traveling Can Trigger Coverage Issues

Your Medicare Advantage plan is typically tied to a local or regional service area. If you move outside that area or travel for extended periods, your coverage may be reduced or unavailable except in emergencies.

This can be problematic if you:

-

Spend part of the year in another state

-

Move to be closer to family

-

Need a second opinion at a renowned medical facility outside your network

Original Medicare does not impose these geographic restrictions. You retain access across the U.S., making it a better fit if flexibility and mobility are important to you.

Enrollment Windows Limit When You Can Change Plans

Another concern is the timeline for making changes if your Medicare Advantage plan no longer fits your needs. You can’t switch any time of year. There are specific enrollment periods:

-

Medicare Annual Enrollment Period: October 15 to December 7 each year. Changes take effect January 1.

-

Medicare Advantage Open Enrollment Period: January 1 to March 31. You can switch Advantage plans or go back to Original Medicare.

-

Special Enrollment Periods: Only triggered by qualifying life events (e.g., moving, losing other coverage).

If your needs change outside of these windows, you may be stuck with your current plan until the next eligible period. This lack of flexibility can be risky if you’re in the middle of a care transition.

Supplemental Benefits Sound Great, But Have Conditions

Medicare Advantage plans often advertise supplemental benefits like dental, vision, hearing aids, transportation, and meal delivery. While these extras are attractive, they often come with restrictions:

-

Limited provider networks for dental and vision

-

Caps on the number of services per year

-

Pre-authorization for non-emergency transportation

-

Geographic availability only within certain zip codes

In 2025, only a portion of plans offer comprehensive supplemental benefits, and access to those benefits can vary based on your location and the plan’s internal rules.

These benefits might seem like a value boost, but they’re not guaranteed to meet your expectations or adapt as your needs grow.

Drug Coverage May Also Be Less Flexible

Many Medicare Advantage plans include Part D prescription drug coverage, but formularies and pharmacy networks vary significantly. You may find that:

-

Your current medications require step therapy or prior approval

-

Your pharmacy is not in-network

-

Brand-name drugs come with higher coinsurance than expected

Once enrolled, switching plans to get better drug coverage can only happen during designated enrollment periods. This limits your ability to adjust quickly if your medication needs change midyear.

Out-of-Pocket Costs Aren’t Always Predictable

While Medicare Advantage plans often include annual out-of-pocket maximums, those maximums can still be quite high. In 2025, the federal cap for in-network services is $9,350, and out-of-network limits (for PPO plans) can be as high as $14,000.

Some plans have lower thresholds, but those plans may come with more restrictions or narrower provider networks.

Also keep in mind:

-

Copayments can add up for frequent visits

-

Out-of-network services may not count toward your in-network maximum

-

Prescription costs are separate from your medical out-of-pocket limit

For someone managing multiple chronic conditions or needing specialized care, these costs can build quickly, especially when flexibility is limited.

Switching Back Isn’t Always Simple

If you’re in a Medicare Advantage plan and want to return to Original Medicare, the transition can be more complicated than expected. The main reason: Medigap plans, which help cover out-of-pocket costs under Original Medicare, may require medical underwriting if you apply outside your initial Medigap enrollment period.

That means the insurer can:

-

Deny coverage

-

Impose waiting periods

-

Charge higher premiums based on health status

Unless you’re within a guaranteed issue window (e.g., during your first 12 months on a Medicare Advantage plan), switching back could come with higher costs or reduced coverage.

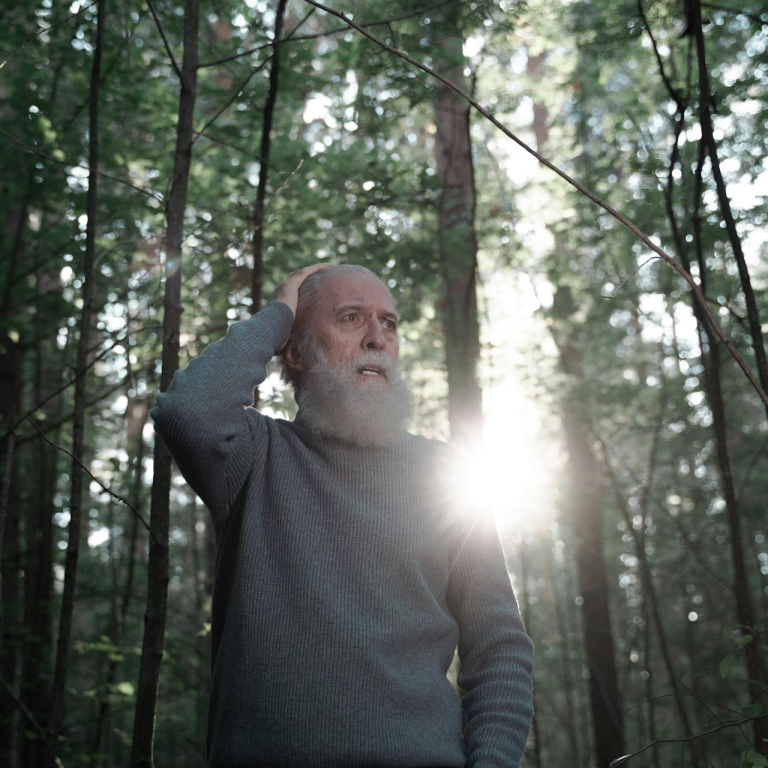

You Might Not Notice the Limits—Until You Hit Them

For many enrollees, Medicare Advantage plans seem to work well—until a situation arises that requires more flexibility. Whether it’s:

-

A health condition that requires a top-tier specialist

-

Travel plans that stretch beyond your service area

-

Changes in your prescription regimen

-

A desire to get a second opinion out of state

The limits of the plan may only become obvious at the point you need them to stretch.

By then, it might be too late to make a change.

Your Healthcare Choices Should Grow With You

Health needs evolve. A plan that fits well at age 65 may feel restrictive at 70 or 75. The best coverage is one that grows with you—not one that locks you into trade-offs that don’t suit your future health priorities.

Think beyond today’s premiums and perks. Look ahead to:

-

How easily you can get care when you need it

-

Whether you can access top hospitals and specialists

-

What happens if you move or your lifestyle changes

-

How much flexibility matters to you long term

These are the questions that matter more than the shiny extras up front.

When Flexibility Matters More Than Frills

Medicare Advantage may look like a perfect fit, especially in the early years of retirement. But if you value the ability to choose your providers freely, travel without network constraints, and avoid prior authorization delays, those extras might not outweigh the limits.

Talk to a licensed agent listed on this website to help you evaluate your needs, your lifestyle, and your future health goals before enrolling in or renewing a Medicare Advantage plan. The right coverage should serve your needs today—and tomorrow.