Key Takeaways

-

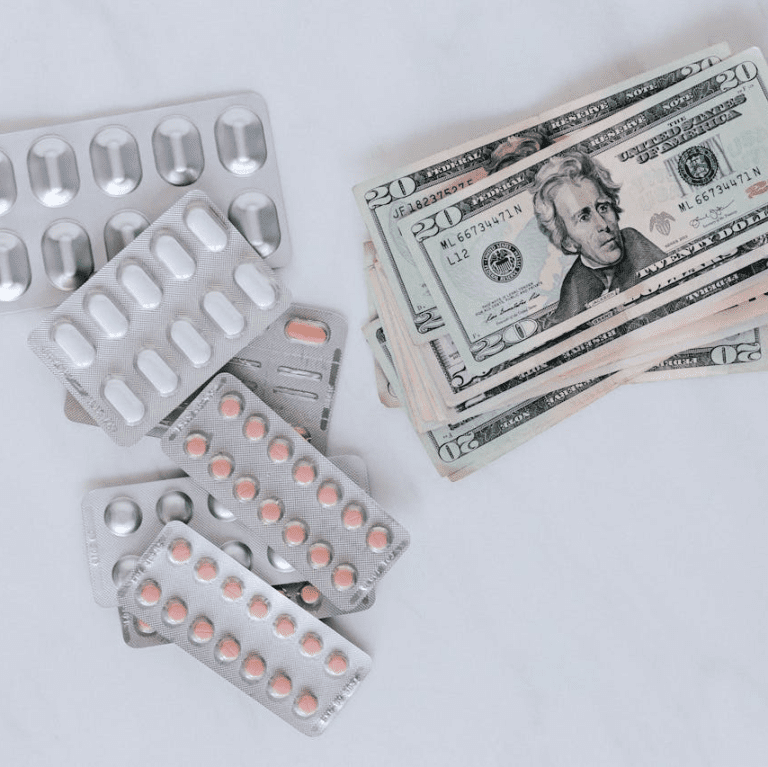

Medicare Advantage plans can have unexpected costs due to limited provider networks, prior authorization rules, and coverage restrictions.

-

Understanding plan structure, including annual out-of-pocket limits and network boundaries, is essential to avoid surprise bills.

The Promises Sound Appealing—But What Are You Really Signing Up For?

When you first hear about Medicare Advantage plans, they may seem like a streamlined solution. These plans are marketed as all-in-one coverage, often promising coordinated care, low monthly costs, and added benefits like dental or vision. But the fine print can introduce risks that may not be immediately clear. If you’re not cautious, you might face out-of-pocket expenses you didn’t budget for.

That’s because, unlike Original Medicare, Medicare Advantage plans operate under different rules that can lead to restrictions, denials, or charges for services you assumed would be covered. Let’s explore the reasons why these surprises happen and what you can do to stay protected.

1. Network Limitations Aren’t Always Obvious

Medicare Advantage plans use provider networks. These networks can be:

-

HMO (Health Maintenance Organization): Requires referrals and limits care to in-network providers.

-

PPO (Preferred Provider Organization): Offers more flexibility but still charges more for out-of-network services.

If you receive care from a provider outside the plan’s network, your costs may not be covered or may be covered only in part. This is especially problematic when you travel, move temporarily, or need specialized care from a provider who is not in your network.

Why this leads to surprise bills:

-

You might assume a specialist or facility is covered, only to discover otherwise after receiving care.

-

Emergency services are generally covered, but follow-up care is often not if done out-of-network.

-

Some providers may leave or join a network mid-year, affecting your coverage even if you didn’t change plans.

2. Prior Authorization Requirements Delay or Deny Care

Medicare Advantage plans frequently require prior authorization for services like:

-

Diagnostic imaging (MRI, CT scans)

-

Home health care

-

Physical therapy

-

Certain surgeries or procedures

This process means the plan must approve the service before you receive it. If the plan denies it, you’re responsible for the full cost unless you file a successful appeal.

What’s happening in 2025:

While efforts are underway to reduce unnecessary prior authorizations, they still exist. In 2024, a federal rule began requiring electronic prior authorization for some services, aiming to shorten wait times. But many services still fall under lengthy manual reviews, and delays remain common.

3. Out-of-Pocket Limits Can Still Feel High

Every Medicare Advantage plan must include an annual out-of-pocket maximum for in-network services. In 2025, the federal maximum allowed is $9,350 for in-network services and $14,000 for combined in-network and out-of-network.

Plans can choose lower limits, but they are not required to. This means you could still end up paying thousands in copayments, coinsurance, and deductibles before hitting your plan’s ceiling.

Misconceptions:

-

Some enrollees confuse this limit with a cap on all medical costs. It applies only to Medicare-covered services and only in-network unless otherwise stated.

-

Extra services like dental or vision may have their own limits or cost-sharing structures not included in the out-of-pocket max.

4. Extra Benefits May Come With Hidden Trade-Offs

Many Medicare Advantage plans advertise additional benefits such as:

-

Dental cleanings and extractions

-

Vision exams and eyewear

-

Hearing aids

-

Fitness memberships

These benefits often sound attractive, but they may be limited in scope, frequency, or provider options. For instance, dental coverage might only include preventive care, and hearing aid allowances might be capped at a low dollar amount.

What you need to know:

-

These extra benefits are not standardized, and coverage varies widely between plans.

-

Providers for these services may be restricted to specific networks, or reimbursements may be lower than expected.

-

Some plans use these benefits as marketing tools but offer minimal actual value.

5. Plan Structures and Coverage Rules Vary Widely

Unlike Original Medicare, which is consistent nationwide, Medicare Advantage plans are offered by private entities and can differ not only by state but by ZIP code. That means:

-

Copays and deductibles vary by plan.

-

Each plan sets its own coverage rules.

-

Formularies (covered drug lists) change between plans.

Timeline implications:

If you choose a plan during the Annual Enrollment Period (October 15 to December 7), it begins January 1 of the following year. But once you’re enrolled, switching to a different plan or returning to Original Medicare outside the Open Enrollment Period (January 1 to March 31) may not be possible unless you qualify for a Special Enrollment Period.

This limited flexibility increases the risk of being stuck with a plan that doesn’t meet your needs, especially if changes happen after you enroll.

6. Emergency and Urgent Care May Be Limited After the Fact

While all Medicare Advantage plans must cover emergency and urgent care anywhere in the U.S., what happens after an emergency visit is where problems arise. For instance:

-

If you’re hospitalized out-of-network, your follow-up care may not be covered.

-

Rehabilitation services like skilled nursing may only be covered if provided by an in-network facility.

The impact:

Many people assume continuity of care post-emergency is included. But unless the services are authorized and provided in-network, you could receive large bills despite a legitimate emergency.

7. Drug Formularies Can Change Anytime

Medicare Advantage plans that include drug coverage (MAPD plans) maintain their own list of covered medications, known as formularies. These can change mid-year with notice, meaning:

-

Your drug may be dropped, requiring a switch or full out-of-pocket payment.

-

Tiers may change, increasing copays or coinsurance.

-

Preferred pharmacies might change, increasing your drug costs if you stay with your regular pharmacy.

What’s required in 2025:

Plans must notify you of any formulary changes in advance, but this doesn’t eliminate the financial impact. Annual Notice of Change (ANOC) letters are sent each September and include formulary updates. If you don’t review this document carefully, you might be caught off guard by new costs starting January 1.

8. Cost Sharing Isn’t Always Straightforward

Medicare Advantage plans often have a complex structure for cost sharing:

-

Flat copays for services like office visits and urgent care

-

Percentage-based coinsurance for higher-cost services like hospital stays

-

Deductibles for certain services

These amounts add up quickly and may differ between services. The lack of transparency in some plan brochures or sales presentations can lead you to underestimate your total financial exposure.

Key point:

Even with an out-of-pocket maximum, you may be responsible for significant expenses upfront, especially in the first half of the year.

9. Denials and Appeals Require Time and Effort

If your Medicare Advantage plan denies coverage for a treatment, you can appeal. However:

-

The process is multi-step and can take weeks or months.

-

You must navigate internal reviews, then move on to external appeal stages if needed.

-

During this time, you may have to delay care or pay out-of-pocket while waiting.

This appeals process can be difficult for those dealing with health challenges and adds a layer of stress to already difficult situations.

When It All Adds Up

The result of these combined factors is that many people who enroll in Medicare Advantage plans with high expectations find themselves facing coverage denials, unexpected bills, and confusing cost structures. These surprises usually appear when care is most needed.

What You Can Do to Protect Yourself

You’re not powerless in the face of these challenges. Here’s what you can do:

-

Compare plans carefully: Don’t focus only on premiums. Review copays, deductibles, drug formularies, and network restrictions.

-

Ask about provider networks: Confirm your doctors and hospitals are in-network before enrolling.

-

Review the ANOC each fall: Stay informed about plan changes that take effect each January.

-

Understand enrollment periods: Know when you can switch plans or return to Original Medicare.

-

Talk to a licensed agent listed on this website: An expert can explain your options clearly and help you choose based on your actual health and financial needs.

Planning Ahead Can Help You Avoid the Shock Later

Medicare Advantage plans may be a suitable option for many people, but they are not one-size-fits-all. The more informed you are, the better decisions you’ll make. If you don’t fully understand the fine print, you could face medical bills that significantly strain your finances.

To ensure you’re choosing the best plan for your needs, speak with a licensed agent listed on this website. They can help you compare available options, understand the trade-offs, and avoid costly surprises.