Key Takeaways

- Reviewing and comparing Medicare Part D plans annually can help beneficiaries find the most cost-effective coverage.

- Utilizing generic drugs, assistance programs, and mail-order pharmacies are essential strategies for managing prescription drug costs during the Donut Hole phase.

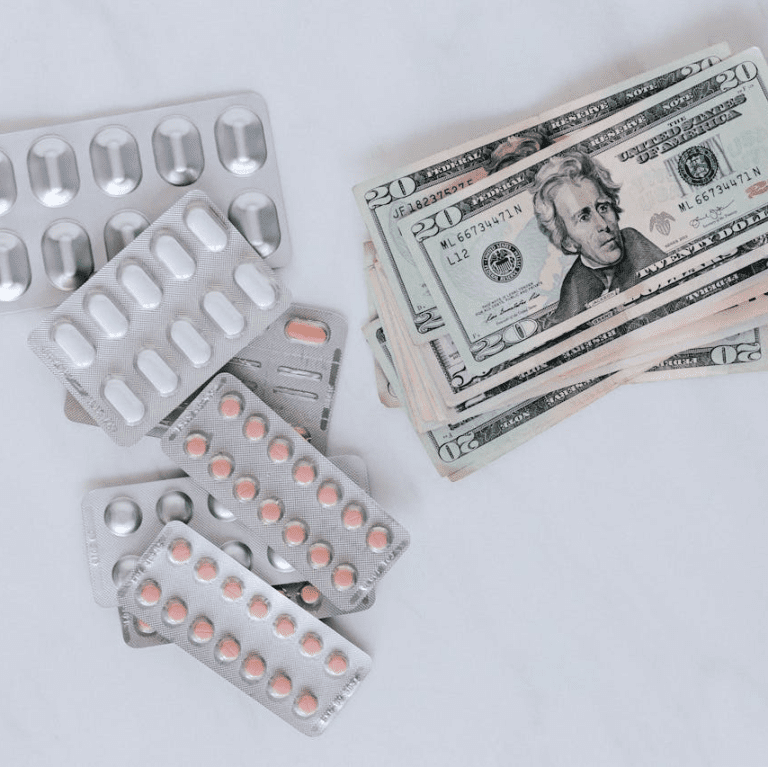

Top Cost-Saving Strategies for Medicare Beneficiaries in the Donut Hole Phase

The Donut Hole, also known as the coverage gap, is a phase in Medicare Part D prescription drug plans where beneficiaries may face higher out-of-pocket costs for their medications. Managing these costs effectively requires understanding and implementing various strategies. Here are some top cost-saving strategies for Medicare beneficiaries in the Donut Hole phase.

Review and Compare Medicare Part D Plans Annually

One of the most effective ways to manage prescription drug costs is to review and compare Medicare Part D plans annually. Each year during the Medicare Open Enrollment period (October 15 to December 7), beneficiaries have the opportunity to switch plans.

Why Compare Plans?

Medicare Part D plans can change yearly, including their premiums, deductibles, copayments, and formularies (the list of covered drugs). A plan that was cost-effective last year might not be the best option this year. By comparing plans annually, beneficiaries can find one that best meets their needs and minimizes out-of-pocket expenses.

How to Compare Plans

- Use the Medicare Plan Finder: This tool on the Medicare website allows you to compare different Part D plans based on your specific medications and pharmacy preferences.

- Check Formulary Changes: Ensure that your medications are still covered by the plan and at a reasonable cost.

- Evaluate Costs: Look at the total cost of each plan, including premiums, deductibles, and copayments.

- Consider Pharmacy Networks: Some plans offer lower costs at preferred pharmacies. Make sure your preferred pharmacy is in-network.

Utilize Generic and Preferred Drugs

Switching to generic or preferred drugs can significantly reduce your prescription drug costs. Generic drugs are typically much cheaper than brand-name drugs and have the same active ingredients and effectiveness.

Benefits of Generic Drugs

- Cost Savings: Generic drugs can cost up to 85% less than brand-name drugs.

- Same Effectiveness: Generics are required by the FDA to have the same active ingredients, strength, dosage form, and route of administration as their brand-name counterparts.

How to Switch to Generics

- Talk to Your Doctor: Discuss with your healthcare provider whether there are generic or lower-cost alternatives to your current medications.

- Check the Formulary: Review your plan’s formulary to find generic or preferred drugs that might be more affordable.

Apply for the Extra Help Program

The Extra Help program assists Medicare beneficiaries with limited income and resources in paying for prescription drug costs. This program can help cover premiums, deductibles, and coinsurance, effectively reducing out-of-pocket expenses and eliminating the Donut Hole phase for those who qualify.

Eligibility for Extra Help

- Income and Resource Limits: The program is available to individuals with an income below 150% of the federal poverty level and limited resources.

- Application: Apply for Extra Help through the Social Security Administration.

Explore Pharmaceutical Assistance Programs

Many pharmaceutical companies offer assistance programs to help cover the cost of medications for those who cannot afford them. These programs can provide discounts or free medications.

How to Access Assistance Programs

- Research Programs: Look into assistance programs offered by the manufacturers of your medications.

- Apply Directly: Apply directly through the pharmaceutical company’s program to receive discounts or free medications.

- Use Online Resources: Websites like NeedyMeds and RxAssist provide information on available assistance programs.

Leverage State Pharmaceutical Assistance Programs (SPAPs)

Some states offer programs to help residents with their prescription drug costs. These programs vary by state and can provide additional support for those in the Donut Hole.

Benefits of SPAPs

- Additional Coverage: SPAPs can provide additional coverage for prescription drug costs that are not covered by Medicare Part D.

- Lower Costs: Beneficiaries can save on their medications by leveraging these state programs.

How to Use SPAPs

- Check Availability: Determine if your state offers an SPAP and what benefits are available.

- Enroll: Enroll in your state’s SPAP if you are eligible to receive additional assistance.

Use Mail-Order Pharmacies for Maintenance Medications

Mail-order pharmacies often provide medications at a lower cost than retail pharmacies, especially for maintenance drugs taken regularly. This can be a convenient and cost-effective option for managing long-term medications.

Advantages of Mail-Order Pharmacies

- Cost Savings: Mail-order pharmacies often offer lower prices for a 90-day supply of medications compared to a 30-day supply at a retail pharmacy.

- Convenience: Medications are delivered directly to your home, saving you trips to the pharmacy.

How to Use Mail-Order Pharmacies

- Check with Your Plan: Verify if your Part D plan has a preferred mail-order pharmacy option.

- Set Up Delivery: Arrange for a 90-day supply of your maintenance medications to be delivered through the mail-order service.

- Ensure Proper Usage: Follow the instructions provided to ensure proper usage and storage of your medications.

Conduct Regular Medication Reviews with Your Healthcare Provider

Regular medication reviews with your healthcare provider can help manage costs and ensure that you are taking the most effective and necessary medications.

Benefits of Medication Reviews

- Identify Unnecessary Medications: Your healthcare provider can help identify any medications that may no longer be necessary, reducing your overall medication costs.

- Adjust Dosages: Adjusting dosages or finding alternative medications can also lead to cost savings.

- Improve Adherence: Regular reviews can help improve medication adherence, ensuring you get the most benefit from your medications.

How to Conduct Medication Reviews

- Schedule Regular Appointments: Make regular appointments with your healthcare provider to review your medications.

- Bring All Medications: Bring all your medications, including over-the-counter drugs and supplements, to your appointments.

- Discuss Changes: Be open to discussing changes to your medication regimen that could lead to cost savings and better health outcomes.

Conclusion

Managing prescription drug costs during the Donut Hole phase can be challenging, but by implementing these strategies, Medicare beneficiaries can significantly reduce their out-of-pocket expenses. Reviewing and comparing Medicare Part D plans annually, utilizing generic and preferred drugs, applying for assistance programs, leveraging SPAPs, using mail-order pharmacies, and conducting regular medication reviews are all effective ways to manage costs. By taking a proactive approach, beneficiaries can navigate the Donut Hole more effectively and maintain access to the medications they need.

Contact Information:

Email: [email protected]

Phone: 5025559012