Key Takeaways:

-

Medicare is divided into four parts: A, B, C, and D. Each part covers different aspects of healthcare, and understanding them can help you choose the right coverage.

-

While Medicare Parts A and B are the foundation of Original Medicare, Part C (Medicare Advantage) and Part D (prescription drug coverage) offer additional options.

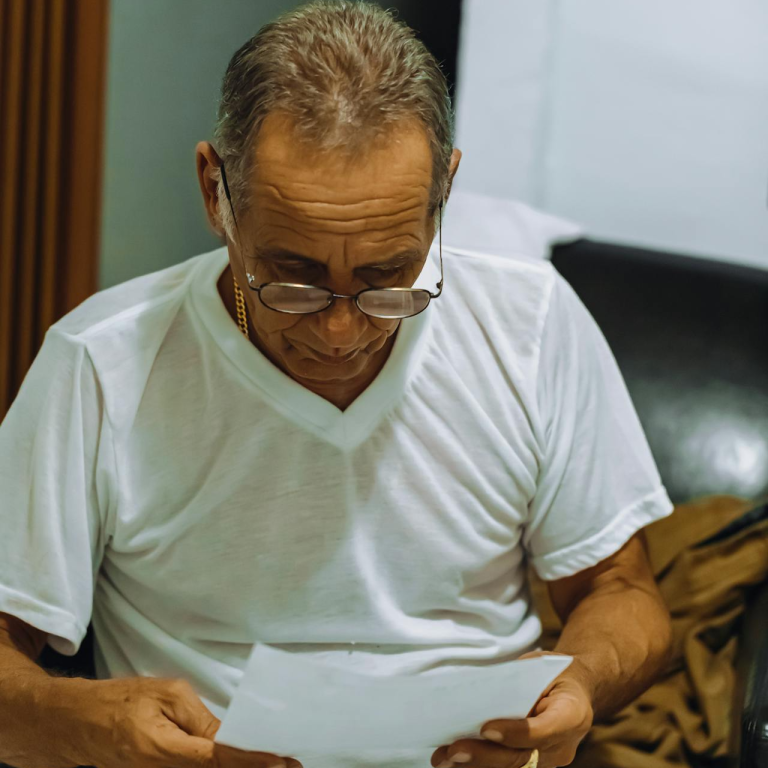

Understanding Medicare: The Basics You Need to Know

If you’re approaching Medicare eligibility or already enrolled, you’ve probably heard about Medicare Parts A, B, C, and D. But what exactly do these parts cover, and how do they work together? Whether you’re signing up for the first time or reconsidering your options, understanding these Medicare components is crucial to making informed healthcare decisions.

Let’s break it all down so you can navigate Medicare with confidence.

Medicare Part A: Hospital Coverage and Inpatient Care

Part A is the hospital insurance portion of Medicare, covering inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you usually don’t have to pay a monthly premium for Part A. However, there are other costs involved, such as deductibles and coinsurance.

What’s Covered Under Part A?

-

Inpatient hospital stays – Covers semi-private rooms, meals, and necessary hospital services.

-

Skilled nursing facility care – Covers short-term stays for recovery after a hospital stay.

-

Hospice care – Provides comfort care for terminally ill patients.

-

Home healthcare – Includes limited services if prescribed by a doctor.

What You’ll Pay for Part A

Even though most people don’t pay a premium for Part A, there is a deductible you must meet before coverage kicks in. Additionally, coinsurance costs can apply depending on the length of your hospital stay.

Medicare Part B: Outpatient Care and Medical Services

Part B is the medical insurance portion of Medicare. It covers doctor visits, preventive services, outpatient care, and medical supplies. Unlike Part A, Part B requires a monthly premium, and the amount can vary based on your income.

What’s Covered Under Part B?

-

Doctor visits – Includes primary care and specialists.

-

Preventive services – Screenings, vaccines, and annual wellness visits.

-

Outpatient care – Covers emergency room visits and outpatient procedures.

-

Durable medical equipment – Includes wheelchairs, walkers, and other medical devices.

What You’ll Pay for Part B

Part B has a monthly premium, an annual deductible, and typically 20% coinsurance for covered services after you meet the deductible. Since there’s no out-of-pocket maximum, costs can add up if you need frequent medical care.

Medicare Part C: Medicare Advantage Plans

Part C, also known as Medicare Advantage, is an alternative way to receive Medicare benefits. These plans are offered by private companies and bundle Part A, Part B, and often Part D (prescription drug coverage) into one plan. Medicare Advantage plans may also include additional benefits like dental, vision, and hearing coverage.

What’s Included in Part C?

-

All benefits of Parts A and B – Covers hospital and medical services.

-

Prescription drug coverage – Many plans include Part D benefits.

-

Extra benefits – May include vision, dental, hearing, and wellness programs.

What You’ll Pay for Part C

Costs for Medicare Advantage vary widely based on the plan you choose. You’ll still pay your Part B premium, and depending on the plan, there may be additional monthly costs, deductibles, and copayments. Some plans offer lower out-of-pocket costs compared to Original Medicare.

Medicare Part D: Prescription Drug Coverage

Part D helps cover the cost of prescription drugs. These plans are offered by private insurance companies and help reduce the amount you pay for medications.

What’s Covered Under Part D?

-

Generic and brand-name drugs – Plans cover different medications at various cost levels (tiers).

-

Formularies – Each plan has a list of covered drugs, so it’s important to check if your prescriptions are included.

What You’ll Pay for Part D

Part D costs include a monthly premium, an annual deductible, and copayments or coinsurance. There’s also an out-of-pocket cap of $2,000 for 2025, meaning once you hit that limit, your medications are fully covered for the rest of the year.

How Do Medicare Parts Work Together?

Understanding how these parts interact is crucial for managing your coverage. Here’s how they fit together:

-

Original Medicare (Parts A & B): The foundation of Medicare coverage, covering hospital and outpatient services.

-

Medicare Advantage (Part C): An alternative way to receive Parts A & B, often with additional benefits.

-

Medicare Prescription Drug Plans (Part D): Can be added to Original Medicare or included in a Medicare Advantage plan.

If you choose Original Medicare, you may also consider enrolling in a Medicare Supplement (Medigap) policy to help with out-of-pocket costs.

Choosing the Right Medicare Coverage for You

Selecting the right Medicare coverage depends on your healthcare needs, budget, and preferences. Here are some key questions to ask yourself:

-

Do you prefer flexibility in choosing doctors and hospitals? (Original Medicare may be better.)

-

Do you want a plan that includes additional benefits like dental and vision? (Consider Medicare Advantage.)

-

Do you take prescription medications regularly? (Ensure you have Part D coverage.)

-

Are you concerned about high out-of-pocket costs? (Medigap might help.)

Making the Most of Your Medicare Benefits

Once you’re enrolled in Medicare, there are steps you can take to maximize your coverage:

-

Use preventive services: Take advantage of screenings and vaccines covered by Medicare.

-

Review your plan annually: Medicare plans and costs change every year, so check if your coverage still fits your needs.

-

Know your enrollment periods: Missing deadlines can lead to late penalties and gaps in coverage.

Ready to Navigate Medicare with Confidence?

Understanding Medicare Parts A, B, C, and D is essential for making the right healthcare decisions. Whether you choose Original Medicare or a Medicare Advantage plan, knowing what each part covers can help you avoid unexpected costs and get the healthcare services you need.

Need personalized assistance? A professional listed on this website can guide you through your options and help you find the best Medicare coverage for your situation.