Key Takeaways

-

The elimination of Medicare’s “donut hole” in 2025 introduces a simplified three-phase prescription drug coverage structure, benefiting enrollees by capping out-of-pocket expenses.

-

Medicare beneficiaries will experience significant financial relief with the new $2,000 annual cap on prescription drug costs.

Simplified Coverage in 2025: The End of the Donut Hole

For years, Medicare beneficiaries have navigated the complex prescription drug coverage phases, including the infamous “donut hole” or coverage gap. As of January 1, 2025, that’s history. The donut hole’s elimination means prescription drug coverage now consists of three straightforward phases, making it easier to understand and manage your costs. Whether you’re new to Medicare or a seasoned beneficiary, here’s what you need to know about these changes and how they affect your pocketbook.

Breaking Down the Three Phases

In 2025, Medicare Part D consists of the following coverage phases:

1. Deductible Phase

At the start of the year, you’ll pay for your prescriptions out-of-pocket until you’ve met your plan’s deductible. The maximum deductible for Part D plans in 2025 is $590. Once you’ve met this amount, you transition to the next phase.

2. Initial Coverage Phase

During this phase, you share the cost of your prescriptions with your plan. For most drugs, you’ll pay a copayment or coinsurance while your plan covers the remainder. This phase lasts until your total prescription drug spending (what you and your plan have paid) reaches $5,030.

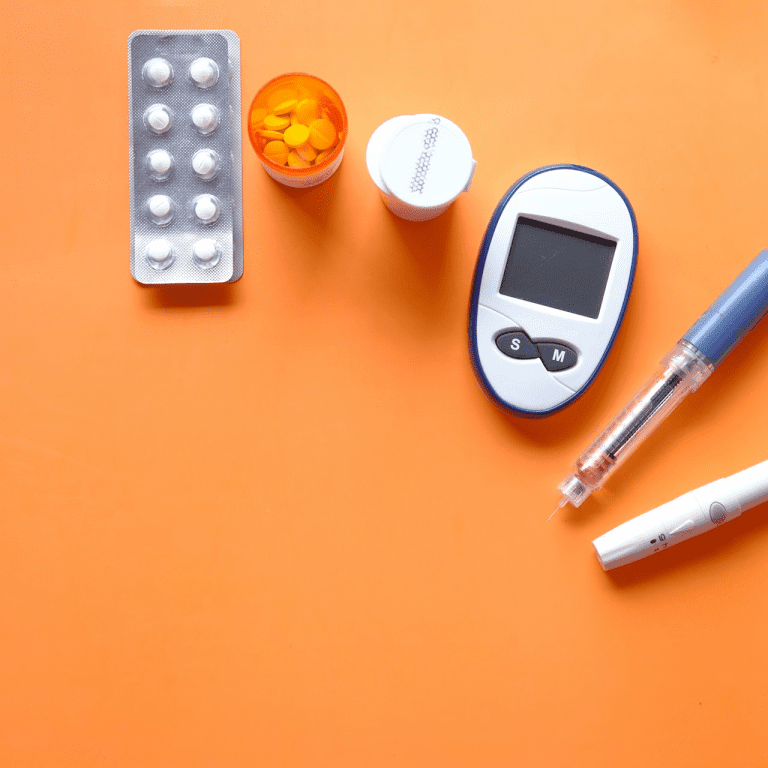

3. Catastrophic Coverage Phase

In 2025, once your out-of-pocket costs hit $2,000, you’ll enter the catastrophic coverage phase. The big news? You won’t pay anything for covered prescriptions after reaching this cap. Medicare and your plan handle 100% of the costs for the rest of the year.

Financial Relief for Beneficiaries

A $2,000 Lifeline

The $2,000 out-of-pocket cap represents a major win for Medicare beneficiaries, particularly for those managing chronic conditions requiring high-cost medications. This change offers predictable and manageable expenses, removing the financial strain previously experienced during the donut hole phase.

Reduced Financial Anxiety

Before 2025, many beneficiaries faced uncertainty about their prescription drug costs after entering the coverage gap. Now, you have the assurance that once you’ve reached the $2,000 limit, your medications are fully covered, allowing you to budget with confidence.

Why Was the Donut Hole Eliminated?

The donut hole had long been a point of confusion and frustration for Medicare beneficiaries. Initially introduced to control costs, it created a significant financial burden for those needing expensive medications. With the rise in drug prices and increased awareness of the gap’s impact, policymakers recognized the need for reform. The elimination of the donut hole is part of broader efforts to make Medicare more equitable and cost-effective for enrollees.

What Happens If You Reach the $2,000 Cap Early?

If you hit your out-of-pocket cap early in the year, the benefits are substantial. You’ll transition into the catastrophic coverage phase, where you won’t pay a dime for your prescriptions. Whether your cap is reached in January or December, you’ll have peace of mind knowing your costs are covered for the remainder of the year.

How Does This Affect Medicare Advantage?

If you’re enrolled in a Medicare Advantage plan with prescription drug coverage (MA-PD), the elimination of the donut hole applies to your drug costs as well. Although Medicare Advantage plans vary in terms of premiums and additional benefits, the $2,000 cap and three-phase structure apply universally to prescription drug costs. Check your plan details to see how these changes are implemented alongside other benefits.

What You Need to Do in 2025

Review Your Plan

During the Annual Enrollment Period (October 15 to December 7), take the time to review your Medicare Part D or Medicare Advantage plan. While the $2,000 cap is a universal benefit, other aspects of your plan, such as premiums and the specific list of covered drugs (formulary), may have changed.

Discuss Your Medications

Talk to your healthcare provider or pharmacist to ensure your medications are covered under your current plan. If there are changes to your formulary or pricing, they can help you find alternatives or generic options to manage costs.

Monitor Your Spending

Keep track of your prescription drug costs throughout the year. Understanding how much you’ve spent helps you anticipate when you’ll reach the $2,000 cap and transition into catastrophic coverage.

Additional Benefits of Part D in 2025

Monthly Payment Flexibility

Another key change in 2025 is the Medicare Prescription Payment Plan. This program allows beneficiaries to spread out-of-pocket costs for prescription drugs over the calendar year through monthly payments. If budgeting for large expenses is a concern, this option provides financial flexibility.

Comprehensive Coverage

With the donut hole gone, you’ll experience smoother transitions between phases and uninterrupted access to your medications. Whether it’s routine maintenance drugs or critical treatments, the simplified structure ensures that your needs are met without unexpected gaps in coverage.

How to Make the Most of These Changes

Stay Informed

Knowledge is your best tool. Stay updated on Medicare changes by reading official communications and discussing updates with your plan provider. Being proactive helps you avoid surprises.

Plan Ahead

If you know you’ll hit the $2,000 cap early in the year, plan your finances accordingly. Use the Medicare Prescription Payment Plan if needed, and explore resources for additional cost assistance if you’re struggling to manage your expenses.

Leverage Preventive Care

Take advantage of Medicare’s preventive care services to avoid costly health issues down the line. Managing your overall health can reduce the need for high-cost prescriptions, saving you money in the long run.

Frequently Asked Questions About the 2025 Changes

Will I Still Have Copayments?

Yes, copayments or coinsurance apply during the deductible and initial coverage phases. However, once you’ve reached the $2,000 out-of-pocket cap, you won’t have any additional costs for covered drugs.

Does the $2,000 Cap Include Plan Premiums?

No, the $2,000 cap applies only to out-of-pocket prescription drug costs, such as deductibles, copayments, and coinsurance. Plan premiums are separate and must still be paid.

What If My Medication Isn’t Covered?

If your medication isn’t on your plan’s formulary, you may need to switch to a covered alternative or pay out-of-pocket. Discuss your options with your healthcare provider to avoid unnecessary expenses.

Are Generic Drugs Included?

Yes, both generic and brand-name drugs count toward your out-of-pocket costs. However, opting for generics can help you reach the $2,000 cap more slowly, stretching your dollars further.

A New Era for Medicare Part D

The elimination of the donut hole marks a pivotal shift in Medicare’s prescription drug coverage. By simplifying the structure and capping out-of-pocket costs, Medicare is now more predictable, equitable, and easier to navigate. This is your opportunity to take full advantage of these changes, ensuring you get the most value from your plan while staying protected from high drug costs.