Key Takeaways

- Medicare Part A covers emergency room visits if they meet certain criteria, such as being medically necessary and leading to hospital admission.

- Understanding the associated costs and how to read your billing statement can help manage expenses and address billing issues effectively.

Medicare Part A Billing for Emergency Room Visits: Is it Covered?

Emergency room visits can be stressful and expensive. Understanding how Medicare Part A covers these visits can help you manage your healthcare costs better. This guide will cover the criteria for coverage, the associated costs, how to read your billing statement, and what to do if your visit is denied coverage.

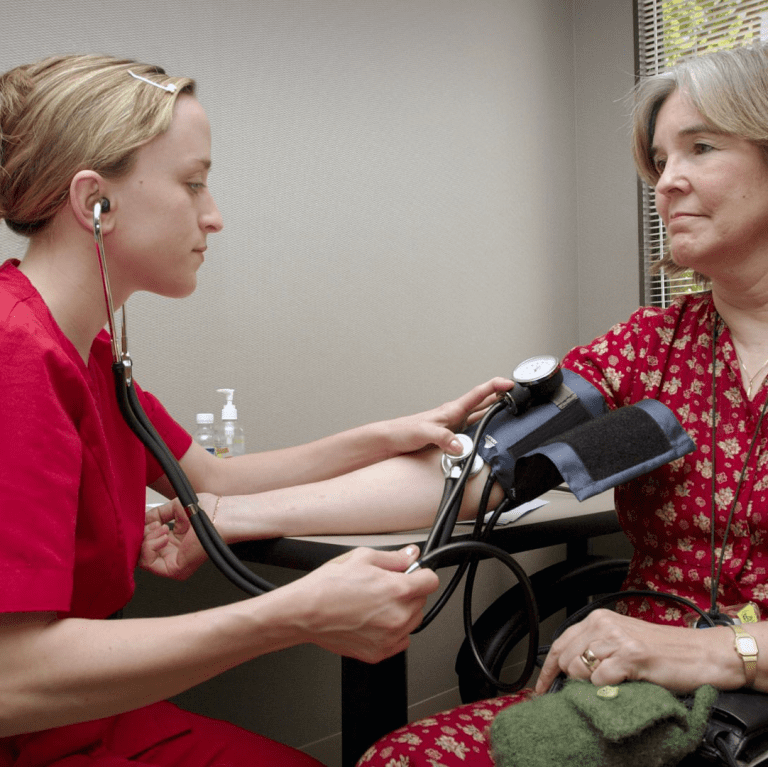

Coverage Criteria for Emergency Room Visits Under Medicare Part A

Medicare Part A, which primarily covers inpatient hospital stays, also provides coverage for emergency room (ER) visits under specific conditions.

-

Emergency Situations: Medicare Part A covers ER visits deemed medically necessary. An emergency is defined as a sudden illness, injury, or condition that could lead to serious health risks or death if not treated immediately.

-

Hospital Admission: For Medicare Part A to cover an ER visit, it often needs to result in a hospital admission. If you are admitted as an inpatient within three days of your ER visit, Part A will cover the ER charges as part of your inpatient stay.

-

Doctor’s Certification: A doctor must certify that the emergency room visit was necessary and required immediate medical attention. This certification, part of the hospital’s records, justifies the emergency care.

-

Medicare-Approved Facility: The ER must be part of a hospital that participates in the Medicare program. Most hospitals in the U.S. accept Medicare, but it’s always good to verify this before an emergency arises.

Understanding these criteria helps ensure your ER visit will be covered by Medicare Part A.

Understanding the Costs Associated with ER Visits

Even with Medicare coverage, there are costs associated with ER visits. Knowing these costs helps you plan and manage your healthcare expenses.

-

Deductibles: In 2024, the Medicare Part A deductible is $1,632 per benefit period. This deductible must be met before Medicare begins to cover any inpatient hospital costs, including ER visits that lead to admission.

-

Coinsurance: After meeting the deductible, you may be responsible for coinsurance. For inpatient stays, Medicare covers the first 60 days without coinsurance. From the 61st to the 90th day, you pay $408 per day, and for days 91 and beyond, using lifetime reserve days, the cost is $816 per day.

-

Outpatient ER Visits: If your ER visit does not result in hospital admission, Medicare Part B may cover it instead. Under Part B, you are responsible for 20% of the Medicare-approved amount for doctor services and a copayment for hospital services after meeting the Part B deductible of $240 in 2024.

-

Additional Costs: Additional out-of-pocket costs may arise for services not fully covered by Medicare. It’s important to review your billing statement to understand these charges.

Knowing these costs helps you prepare for the financial aspects of an ER visit.

How to Read Your Medicare Part A ER Billing Statement

Understanding your Medicare Part A billing statement is crucial for verifying that all charges are accurate. Here’s how to navigate your ER billing statement:

-

Personal Information: Check that your personal details, including your name, Medicare number, and billing period, are correct. Any discrepancies can lead to billing errors.

-

Dates of Service: Verify the dates listed for your ER visit to ensure they match the actual date you received care. This confirms that the charges correspond to your ER visit.

-

Description of Services: Review the descriptions of services provided during your ER visit. Ensure these descriptions accurately reflect the care you received.

-

Provider Information: Confirm that the listed healthcare providers and hospital are the ones who treated you. Incorrect provider information can indicate billing errors or potential fraud.

-

Charges and Payments: This section details the total charges, Medicare-approved amounts, payments made by Medicare, and any remaining balance you owe. Ensure that the amounts listed are correct and reflect your coverage.

-

Deductibles and Coinsurance: Verify that the deductible and coinsurance amounts are calculated correctly based on your Medicare plan. Errors here can lead to overpayment.

-

Additional Notes: Review any additional notes or comments for further explanation of charges or services.

By thoroughly reviewing your billing statement, you can identify and address any errors or discrepancies.

Steps to Take if Your ER Visit is Denied Coverage

If your ER visit is denied coverage by Medicare Part A, follow these steps to resolve the issue:

-

Review the Denial Notice: Carefully read the denial notice from Medicare to understand why your ER visit was not covered. Common reasons include lack of medical necessity, incorrect billing codes, or incomplete documentation.

-

Contact Your Healthcare Provider: Reach out to the billing department of the hospital or healthcare provider that treated you. Explain the denial and request a detailed explanation. Often, the issue can be resolved by correcting billing errors or providing additional documentation.

-

File an Appeal: If the denial is not resolved through the healthcare provider, you have the right to file an appeal with Medicare. The denial notice should include instructions on how to file an appeal. Submit all relevant documentation, including medical records and a statement from your doctor supporting the necessity of the ER visit.

-

Contact Medicare for Assistance: If you need help with the appeal process, contact Medicare at 1-800-MEDICARE (1-800-633-4227). Medicare representatives can provide guidance on the steps to take and help ensure that your appeal is properly submitted.

-

Follow Up: Regularly follow up to check the status of your case. The appeal process can take time, so stay informed and provide any additional information requested by Medicare.

-

Seek Help from an Advocate: If you encounter difficulties during the appeal process, consider seeking help from a Medicare advocate or legal assistance program. These professionals can provide additional support and help you navigate the appeal process more effectively.

By taking these steps, you can address coverage denials and ensure your ER visit is appropriately covered under Medicare Part A.

Navigating Medicare Part A Billing for ER Visits

Understanding how Medicare Part A covers emergency room visits, the associated costs, how to read your billing statement, and the steps to take if coverage is denied is crucial for managing your healthcare expenses effectively. By familiarizing yourself with these aspects, you can ensure you receive the coverage you are entitled to and address any billing issues promptly.

Contact Information:

Email: [email protected]

Phone: 2675558901