Key Takeaways

-

Medicare remains an essential healthcare option in 2025, adapting to meet the needs of diverse beneficiaries.

-

Understanding your Medicare options ensures you make informed decisions amidst a growing array of healthcare choices.

Adapting Medicare: A Foundation You Can Trust

Medicare continues to prove its relevance in 2025, offering robust and flexible options for healthcare coverage. While new healthcare solutions seem to emerge every year, Medicare’s ability to evolve and address the needs of its beneficiaries ensures it remains a cornerstone for millions.

Medicare’s structure provides comprehensive coverage that caters to individuals over 65, younger people with disabilities, and those with end-stage renal disease. As healthcare options expand, the security and predictability Medicare offers are more important than ever.

Navigating Medicare’s Core Parts

Medicare Part A: Hospital Coverage You Rely On

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and limited home healthcare services. In 2025, beneficiaries are responsible for a $1,676 deductible per benefit period. This part of Medicare continues to provide critical hospital coverage that often forms the bedrock of healthcare needs.

Medicare Part B: Your Partner in Outpatient Care

Covering outpatient care, preventive services, and durable medical equipment, Part B is an essential complement to Part A. With a standard premium of $185 and an annual deductible of $257 in 2025, Part B remains affordable while providing access to routine and specialized care. Preventive services, such as cancer screenings and flu shots, highlight Medicare’s focus on keeping you healthy.

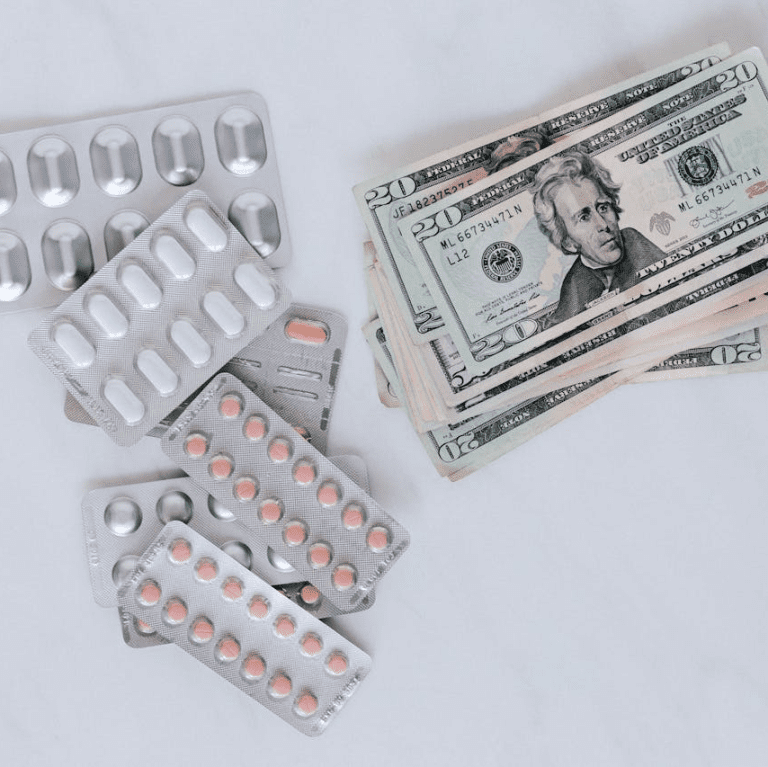

Medicare Part D: Prescription Drug Coverage That Matters

Prescription drugs are a significant expense for many, and Part D’s out-of-pocket cap of $2,000 in 2025 alleviates financial strain. With a deductible limit of $590, Part D continues to evolve, offering better financial protections while maintaining accessibility to life-saving medications.

How Medicare Stays Ahead

A $2,000 Cap on Prescription Drug Costs

The introduction of a $2,000 annual out-of-pocket cap for Part D beneficiaries is a game-changer. This improvement ensures that even those with high medication needs have predictable costs, enhancing financial security and access to necessary treatments.

Spreading Costs with the Medicare Prescription Payment Plan

Beneficiaries can now spread their out-of-pocket prescription costs over monthly payments. This payment option makes managing healthcare expenses more straightforward and budget-friendly for many Medicare users.

Increased Plan Flexibility

Medicare Advantage plans continue to adapt with supplemental benefits like vision, hearing, and dental care. Additionally, expanded Special Needs Plans (SNPs) cater to beneficiaries with specific health or financial circumstances, emphasizing Medicare’s commitment to inclusivity.

Staying Competitive Amidst Private Healthcare Options

As private healthcare solutions flood the market, Medicare’s transparent pricing and comprehensive coverage stand out. While private options often have hidden costs or limited networks, Medicare ensures predictable expenses and access to a wide range of providers. Its enduring stability gives beneficiaries peace of mind when managing healthcare decisions.

Key Enrollment Periods in 2025

Annual Open Enrollment (October 15 to December 7)

During this period, you can review your Medicare plan and make changes to suit your evolving needs. Whether switching to a new plan or adjusting your current one, Open Enrollment provides the perfect opportunity to ensure your coverage aligns with your healthcare priorities.

Special Enrollment Periods

Life events, such as losing employer coverage or moving to a new area, may qualify you for a Special Enrollment Period. These opportunities ensure that unforeseen changes don’t disrupt your access to healthcare.

General Enrollment Period (January 1 to March 31)

If you missed signing up during your Initial Enrollment Period, the General Enrollment Period allows you to join Medicare. Coverage begins on July 1, ensuring you’re not left without healthcare options for long.

Balancing Medicare with Employer and Retiree Coverage

In 2025, many beneficiaries coordinate Medicare with other forms of insurance, such as employer or retiree health plans. This combination often provides the most comprehensive coverage at the lowest cost. By understanding how Medicare integrates with other coverage options, you can maximize your benefits while minimizing out-of-pocket expenses.

The Importance of Preventive Care

Medicare’s emphasis on preventive care continues to set it apart in 2025. Services such as annual wellness visits, vaccinations, and cancer screenings help catch potential issues early, reducing long-term costs and improving health outcomes. These no-cost or low-cost services make it easier to stay proactive about your health.

Financial Assistance Options

Medicare Savings Programs

For those with limited income, Medicare Savings Programs offer help with premiums, deductibles, and copayments. These programs ensure that cost is not a barrier to accessing essential healthcare.

Extra Help for Prescription Drugs

The Extra Help program assists eligible beneficiaries with Part D costs, including premiums, deductibles, and copayments. If your income and resources meet specific thresholds, this program can significantly reduce your prescription drug expenses.

How to Make the Most of Your Medicare Benefits

Review Your Annual Notice of Change (ANOC)

Every fall, you receive an ANOC outlining changes to your Medicare plan for the upcoming year. Reviewing this document ensures you’re aware of updates to premiums, deductibles, and benefits, allowing you to make informed decisions during Open Enrollment.

Stay Within the Network

For those with Medicare Advantage plans, using in-network providers ensures lower out-of-pocket costs. Original Medicare offers the flexibility to see any provider who accepts Medicare, making it essential to understand your plan’s rules to maximize savings.

Utilize Telehealth Services

Telehealth has become a vital part of healthcare, and Medicare’s coverage for these services remains strong in 2025. Accessing care from the comfort of your home saves time and reduces exposure to potential illnesses.

The Road Ahead for Medicare

Medicare’s adaptability ensures it remains a cornerstone of healthcare in 2025. From its comprehensive coverage to new cost-saving measures, it continues to meet the needs of its diverse population. Staying informed about changes and enhancements allows you to take full advantage of what Medicare offers.

Empowering Your Healthcare Decisions

As healthcare options continue to expand, Medicare stands as a reliable and adaptable choice. By understanding its structure, staying informed about updates, and leveraging available benefits, you can ensure your healthcare needs are met without unnecessary stress or expense.